An Introductory Guide

One of the most impactful things a B2B marketing team can do is to build brand awareness. Companies with a strong brand are able to generate more leads. If a prospect knows the company and its products, they are more likely to reach out when they start a new purchasing cycle. A strong brand can lead to more wins too. If a customer has trust in the reputation of a company then they will be more confident selecting that company over lesser-known vendors.

You are undoubtedly familiar with the concept of a brand in the consumer world, but what exactly does it mean to have a brand in the business world? And how do you build a B2B brand? In this guide to B2B brand awareness we’ll answer both of those questions.

What is a B2B Brand?

The emotional reaction a business person has when interacting with company, products, and its employees.

When most people think of “brand” they think about consumer companies like Apple, Disney, or Netflix. But brands are important in the world of B2B marketing too. IBM, Cisco, Oracle, and Accenture are all B2B brands that recently ranked among the top 50 of Forbes Most Valuable Brands. Brand is an abstract concept that is difficult to define in simple terms, but it refers to the emotions evoked when you think about a company, its products, and the associated customer experience.

In the B2B marketing world more established brands like SAP, Capgemini, and HP Enterprise might evoke feelings of trust, confidence, and quality. Challenger brands like Gong, Stripe, and Snowflake are typically associated with concepts like innovation, speed, and disruption.

In B2B, brands drive multi-million dollar purchases

Brand can have a significant influence over which tech vendor wins a deal. B2B technology purchases often amount to hundreds of thousands, if not millions of dollars. Business buyers select products based upon the reputations of the brands behind them just as consumers do. In many cases, an executive’s job is on the line when they make a big purchase. Whether or not the technology they select solves the business problem it was intended to fix can mean the difference between getting a promotion and looking for a new job.

More conservative decision makers prefer to buy from established companies with strong brands such as SAP, Oracle, and Microsoft. In the 1980s and 90s there was a popular saying that “No one ever got fired for buying IBM.”

Challenger brands have quickly captured loyalty from large enterprise buyers

In recent years, a new wave of innovators has emerged that are willing to take a greater risk in return for a higher potential reward. These buyers may be less concerned about the strength of a technology vendor’s brand and more focused on the competitive advantage that can be gained from a disruptive technology.

Software vendors such as Salesforce.com, Hubspot, and Zendesk are examples of innovators that have capitalized on this new risk-reward equation in the technology sector. In the past 20 years these “challenger brands” have catapulted themselves into leadership positions atop multi-billion-dollar software categories. In many cases these newer companies have stolen market share from the more established mega-vendors.

In the long-term, having a strong brand can result in a higher market capitalization. Private companies with strong brands seeking to raise money from venture capital firms will realize a higher valuation. Similarly, a public company with a strong brand will benefit from a higher stock price when it goes through an IPO and a higher long-term market capitalization as its stock continues to trade.

The value of greater brand awareness can be seen in the sales cycle as well. With greater awareness more prospects will reach out to you resulting in lower lead generation costs. With a stronger reputation more C-level buyers will be champion you in vendor selection. There are long-term benefits to greater brand awareness as well. Stronger brands generate higher valuations at IPO and benefit from more goodwill during acquisitions.

The Brand Discovery Process

Some consumers discover brands through social media

The way business buyers discover new technology brands is not that different from the way consumers discover new brands. Think about how you learn about new consumer technology brands. Have you purchased any new gadgets or devices like home security cameras, smart speakers, or laptops recently? Where did you first hear about the brands you considered and ultimately selected? Think about the mobile apps you can’t live with out (e.g. UberEats, TikTok, Lensa). How did you first learn about these apps?

Others discover brands through friends and family

In our consumer lives we learn about new technology brands in a variety of ways. Our friends and family members are highly influential. If you hear your peer group talking about a new gadget they recently purchased at a party or on social media, then you are likely to look it up. Advertising is another common way to learn about new tech. Everywhere you go there are brands trying to get your attention – whether you are searching on Google, checking your newsfeed on social media, watching live broadcast television, or listening to streaming radio stations. For major purchases, most consumers consult the advice of “experts” to select which brand to choose. Experts typically publish reviews of mobile apps and connected devices in online magazines, blog posts, or YouTube videos.

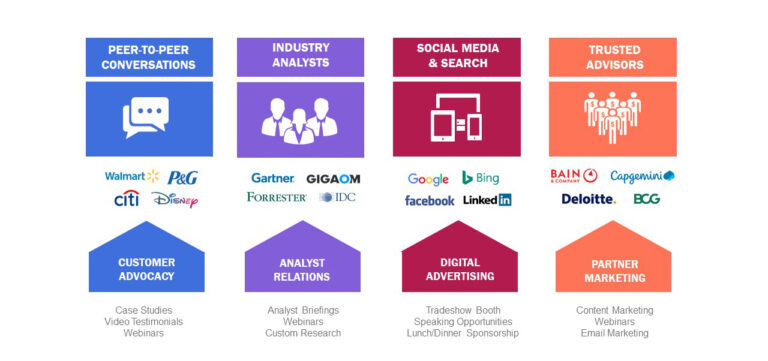

Businesses often discover brands through peers and trusted advisors

Business buyers discover new technology brands in similar ways. Peers that work in the same profession at other companies can be highly influential. If you see your peers talking about a new SaaS vendor they are implementing in LinkedIn Groups or at a conference then you will be likely to check it out. Advertising is also common in B2B. Tech brands push digital ads out to search engines, social media, and online versions of trade publications. B2B buyers also consult experts on major purchasing decisions. In the business world, it is common to pay for the advice of these experts, which might include industry analyst firms like Gartner, Forrester, and IDC or trusted consulting firms like Accenture, EY, and Deloitte.

How to Build Awareness for a B2B Tech Brand

There is no one “best” way to build a brand. A combination of approaches is best.

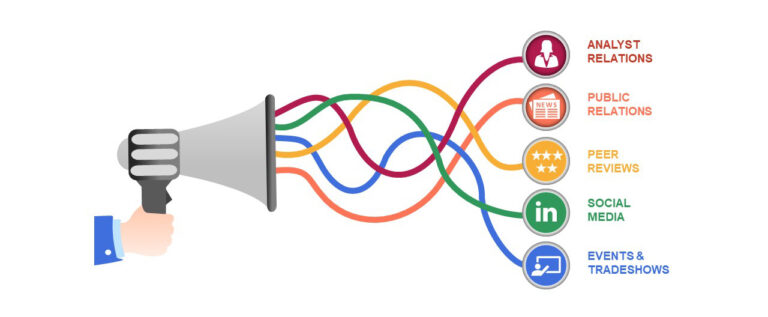

There is no generally agreed upon set of best practices for establishing brand awareness as a technology vendor. However, there are a common set of marketing programs that map to the B2B buyer’s brand discovery process above. Most vendors use marketing strategies such as public relations, analyst relations, advertising, online reviews, social media, and industry tradeshows.

Real World Example

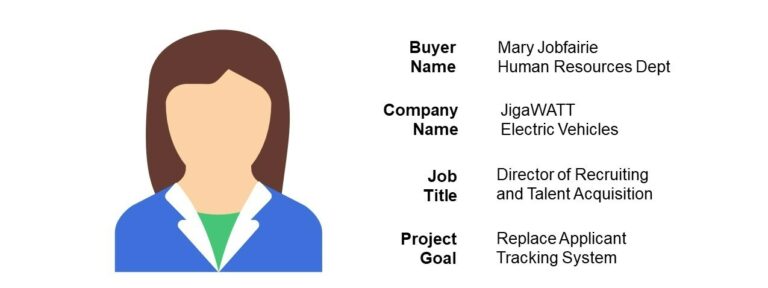

Example – How does an HR leader discover brands for recruiting software?

To make this all easier to understand let’s consider a fictitious example – a HR leader who needs to purchase Talent Acquisition Software – specifically – an Applicant Tracking System (ATS) for their in-house recruiting program. An ATS is just a fancy name for HR software that captures job applications online and manages candidates through the interviewing process.

The Buyer

Mary Jobfairie is a Director of Recruiting at a $1B electric vehicle company named JigaWATT. Her company is growing quickly. In addition to partnering with a world-class search firm, she also needs to replace her existing Applicant Tracking Systems to manage the pipeline of candidates sourced by her in-house team. She currently uses an application from a company called JOBfilla. The vendor was acquired by MonstaTEK a few years ago. Since the acquisition, most of the top developers have left JOBfilla and it has not released many new features. HR managers complain that the software is complicated to use. For example, it takes 45 minutes to post a new job to her company’s website. It is time for Mary to upgrade to something better.

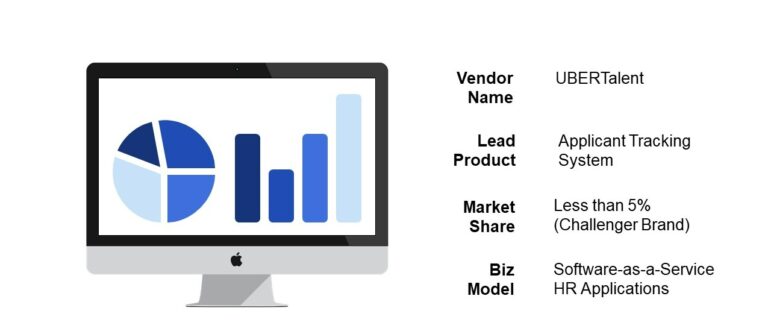

The Seller

UBERTalent is a small, but fast-growing HR software vendor that offers an Applicant Tracking System. UBERTalent wants to increase its brand awareness and reputation with buyers like Mary. How can they increase the odds that Mary has heard of them and will consider them during her purchasing process?

To answer these questions, we need to understand how Mary discovers and learns about new technology vendors.

Public Relations

Some buyers read industry trade publications

Mary and her peers read various online publications to keep up with the latest trends and developments in the world of HR and recruiting. In today’s world everyone is talking about digital transformation of the employee experience. As a result, many of the stories on HR-centric media sites are focused on tech. To gain awareness with buyers like Mary, UBERTalent will want to appear prominently in these types of publications, perhaps by authoring articles on topics like “How AI can help optimize your organization’s talent pipeline?”

Mary and her peers also consume news from national publications like the Wall Street Journal, Forbes, or Inc magazine. UBERTalent can try to get their name mentioned in articles relevant to HR or hiring trends. For example, suppose the CEO was quoted in a Fast Company article about “How Gen Z Employees Want to Work for Companies that Make the World a Better Place.”

Media coverage and bylined articles can help build brand awareness

To get quoted or place articles in the media, UBERTalent will want to launch a public relations program. The marketing team might hire a PR Director or an external agency to interface with the media. Many companies do both. UBERTalent will identify the list of publications that it wants to be mentioned in then regularly reach out to the relevant journalists with pitches for story ideas.

Tech vendors also publish a regular series of press releases to announce “hard news” like product releases, new executives, mergers and acquisitions with hopes of getting media coverage as well. These are less likely to be noticed by buyers like Mary, but more likely tracked by experts at analyst firms that monitor trends amongst technology vendors.

Analyst Relations

Buyers often consult industry analyst on new technology decisions

Another way that buyers like Mary learn about new technology vendors is through industry analysts. Firms like Gartner, Forrester, and IDC study technology like Applicant Tracking Systems then publish research advising corporate buyers on how to select the best vendor. In some markets, the vendors are ranked based upon their capabilities and market share. Gartner publishes a vendor ranking called the “Magic Quadrant,” which is the best known. Forrester publishes a series of “Waves” for different technology segments. IDC publishes “Marketscapes.”

Buyers like Mary will consult the research published by industry analysts when making purchasing decisions. They might also have a phone call with the analyst firms to discuss the company’s requirements for recruiting software and to ask questions about the capabilities of different vendors. Analysts can be highly influential in technology purchasing decisions. The two or three vendors that rank highest in analyst evaluations are generally considered to be safe purchasing decisions by conservative buyers.

Positive analyst coverage and rankings are another way to build awareness

As a result, tech vendors such as UBERTalent will want to engage the analyst firms to educate them about the features and benefits of their offerings with the aim of getting favorable rankings for their products in the published research. Every tech vendor wants to be ranked in the leadership square of the Gartner Magic Quadrant. It is the equivalent of making the Final Four in the NCAA Basketball tournament.

It is a good practice to have a regular dialogue with each of the Tier 1 analysts covering the market to ensure that these influencers are aware of new product releases, partnerships, and technology enhancements that might be relevant to purchasing decisions. Larger tech vendors will hire a dedicated analyst relations team to manage communications with Gartner, Forrester, and IDC as well as the dozens of smaller “Tier 2” and “Tier 3” firms that focus on specific vertical industries or use cases.

Peer Reviews

Buyers place the highest value on feedback from peers in their industry

Business buyers like Mary also rely heavily on the opinions of their peers in the industry when making technology purchases. When researching new Applicant Tracking Systems, she will likely call several other HR leaders in her network to ask them which vendors they use and why. The opinions Mary will get from her peers will be the most influential on her decision-making process – even more important the rankings from analysts. Most business buyers value real-world feedback from actual users of the product as the most trustworthy source of information.

G2, Capterra, TrustRadius are a few of the most popular online review sites

In recent years, a new group of online review sites have emerged in the market that enable buyers to share opinions about B2B software on a much larger scale. These sites, which include G2, TrustRadius, Capterra, and SoftwareAdvice capture detailed feedback directly from end-users of technology products via online reviews and ratings. As these new “online review” firms have collected more reviews from customers they have begun to publish their own vendor rankings and buyer guides that are alternatives to the Gartner Magic Quadrant and Forrester Wave.

Customer advocacy programs are used to boost rankings on online review sites

However, there is a big difference between the traditional analyst firms like Gartner and the new online review sites like G2 – price. Whereas a business like Mary’s might have to spend $50K per year to get access to Forrester analysts and research, she can access the reviews on Capterra for free.

As online review sites grow in popularity, marketers need to ensure that the reviews posted on online review sites are generally positive. Just like HR managers want a five-star Glassdoor review, marketing managers want a five-star rating on TrustRadius. Many tech marketers have created “customer advocacy” programs that encourage users of their products to proactively share positive feedback about their experience at online review sites. Advocacy programs are usually managed by a special Customer Marketing function that is focused exclusively on turning users into raving fans that create positive word-of-mouth buzz.

Customer Marketing pros don’t limit their efforts to soliciting reviews on G2, TrustRadius, and Capterra. Tech marketers also capture customer real-world feedback in their own content formats such as written case studies, webinar presentations, or video testimonials. The case studies can be shared on social media or posted on the corporate website so that buyers like Mary can easily discover them.

Events and Tradeshows

Many buyers go to industry, analyst, and vendor events to learn about new technologies

Buyers like Mary also go to industry tradeshows and conferences to learn about new technology vendors. Contrary to popular belief, COVID did not kill the tradeshow. Business events are back and bigger than ever. While many offer a hybrid option for remote attendees, there are still a meaningful number of people that prefer to join in-person because the experience is so much better and the networking opportunities are so much greater.

Each major industry hosts big shows. For example, HIMMS is the big show in the healthcare industry. CES (formerly Consumer Electronics Show) is the must attend event in the technology space. NRF’s Big Show is the big show in the retail industry. The major analyst firms such as Gartner, Forrester, and IDC each host conferences for their customers on various technology topics ranging from cybersecurity to customer experience. Industry trade groups also host smaller events for their membership community that focus on topics relevant to the financial services industry, higher education market, or industrial manufacturing sector. And technology vendors like Microsoft, SAP, Oracle, Salesforce.com, Amazon, Google, and Cisco host their own industry conferences with their user communities to discuss product roadmaps and share best practices.

Tradeshows are another way to build brand awareness

Technology vendors want to have exhibit booths and purchase sponsorship packages for these conferences to raise brand awareness with prospective buyers. For example, UBERTalent may want to purchase a 20-foot by 20-foot booth at the SHRM (Society for Human Resources and Management) Annual Conference and Exposition to reach HR and recruiting professionals in attendance. If Mary and her peers attend the SHRM show they will get exposed to UBERTalent’s brand when walking the exhibition floor or perhaps listening to their CEO speak on a panel about talent acquisition.

Marketing teams will hire event marketing professionals to coordinate the activities before, after, and during these events. Event marketing professionals are charged with setting up the exhibition booth, selecting tchotkes to give away, and capturing leads from attendees.

More Ways to Build Brand Awareness

Other ways to build awareness include digital and real world ads, professional associations, and influencer marketing.

We covered five of the primary strategies for B2B SaaS and cloud companies to build brand awareness – public relations, analyst relations, peer reviews, social media, and events.

But these are not the only strategies. Other ways to generate B2B brand awareness include:

- Digital Advertising – Text, image, and video ads displayed on search engines, social media, or other websites.

- Real World Advertising – Traditional ad formats displayed on print, TV, radio, or out-of-home (billboards, airports).

- Industry Associations – Participating in professional organizations or advertising through them.

- Influencer Marketing – Briefing industry opinion leaders at consulting firms, wall street analysts, or venture capital firms.

The Best Way to Build Brand Awareness

There is no best way to build a brand. Different audiences react to different channels.

Which of the brand awareness strategies outlined above is the best? The answer will depend. Different types of audiences respond to different channels. In general, however, most SaaS and cloud marketers prefer digital channels such as social media, peer reviews, and online advertising over traditional approaches such as public relations, tradeshows, and real world advertising. Technology enables digital channels to scale faster than the traditional approaches. The digital media also tend to offer much richer data about the effectiveness of the campaigns, which can be used to demonstrate the ROI of the programs.

Although, there is more data available from digital channels, much of the way buyers discover new brands is not measurable. The best brands get word-of-mouth buzz. Buyers learn about them talking with peers and colleagues on zoom meetings, slack channels, or face-to-face conversations. The lack of visibility into these offline or private communications is one of the biggest challenges for brand marketers today and will continue to be for the foreseeable future.

When thinking about the ROI of brand development initiatives it is important to remember that every marketing program you run to build awareness, also results in lead generation as well. Sometimes the influence is complicated and indirect. For example, a prospective buyer like Mary might ask a Gartner analyst for a short list of vendors to consider for her ATS project. The analyst recommends UBERTalent for Mary’s specific use case, because s/he remembers the strengths of your product from a briefing you conducted three months earlier. Mary may never mention the interaction with Gartner during the sales process so the marketing team may never know how she discovered them. However, the lead is a direct result of your analyst relations program.

Learn more about B2B Demand Generation in our online guide.

Latest Brand Awareness insight

50 Great Mission Statements from Innovative Companies

Public Relations ROI

Social Media

Social channels are another way to build brand awareness

Social media is another great way to build awareness. Mary and her peers might regularly check their LinkedIn feed for news from their network. Additionally, Mary might belong to several HR professional groups that focus on topics like Diversity & Inclusion, Recruiting Talent, or Remote Workforce Development.

LinkedIn Ads and content posts help build awareness

Vendors like UBERTalent can encourage their employees to post news and content via their LinkedIn personal accounts. Content that is liked and viewed widely on social networks gets boosted by algorithms and gains higher levels of visibility with second degree contacts. Another option that vendors like UBERTalent can choose is to pay for advertisements on LinkedIn. Marketers can run highly targeted ads that appear in the news feeds of employees working only at selected companies or with specific job titles. For example, UBERTalent might run LinkedIn ads targeted only at HR professionals working at companies that fit their ideal customer profile.

Facebook and Twitter are secondary channels for business buyers

Although LinkedIn is the most popular social media platform for business professionals, it is not the only option for building brand awareness. Buyers like Mary consume information from a variety of social platforms including Facebook, Twitter, and Instagram. Although, the primary use of Facebook is personal use, more and more tech marketers are running ads on this traditional B2C platform due to the attractive price point and precise level of targeting available. Facebook offers advertisers the ability to offer extremely targeted ads to users based upon all the information it collects through user posts and activities.