Sales intelligence software helps go-to-market teams to identify the right companies and the right decision-makers to target for prospecting. ZoomInfo, Apollo, and Cognism are three of the largest sales intelligence vendors. Each company houses a large database of millions of companies along with firmographic data about each, such as the headquarters location, vertical industry, and employee count. They also track the job titles and contact details for decision-makers at each company, such as the business email address, mobile phone number, and LinkedIn profile. Sales intelligence technology not only helps GTM teams identify who to target, but it also recommends when to target them.

Each major platform provides alerts about product launches, mergers/acquisitions, executive leadership changes, and indications of early purchasing activity on third-party websites. The data from sales intelligence applications is usually fed into CRM applications such as Salesforce.com and Hubspot, as well as prospecting tools such as SalesLoft and Outreach.

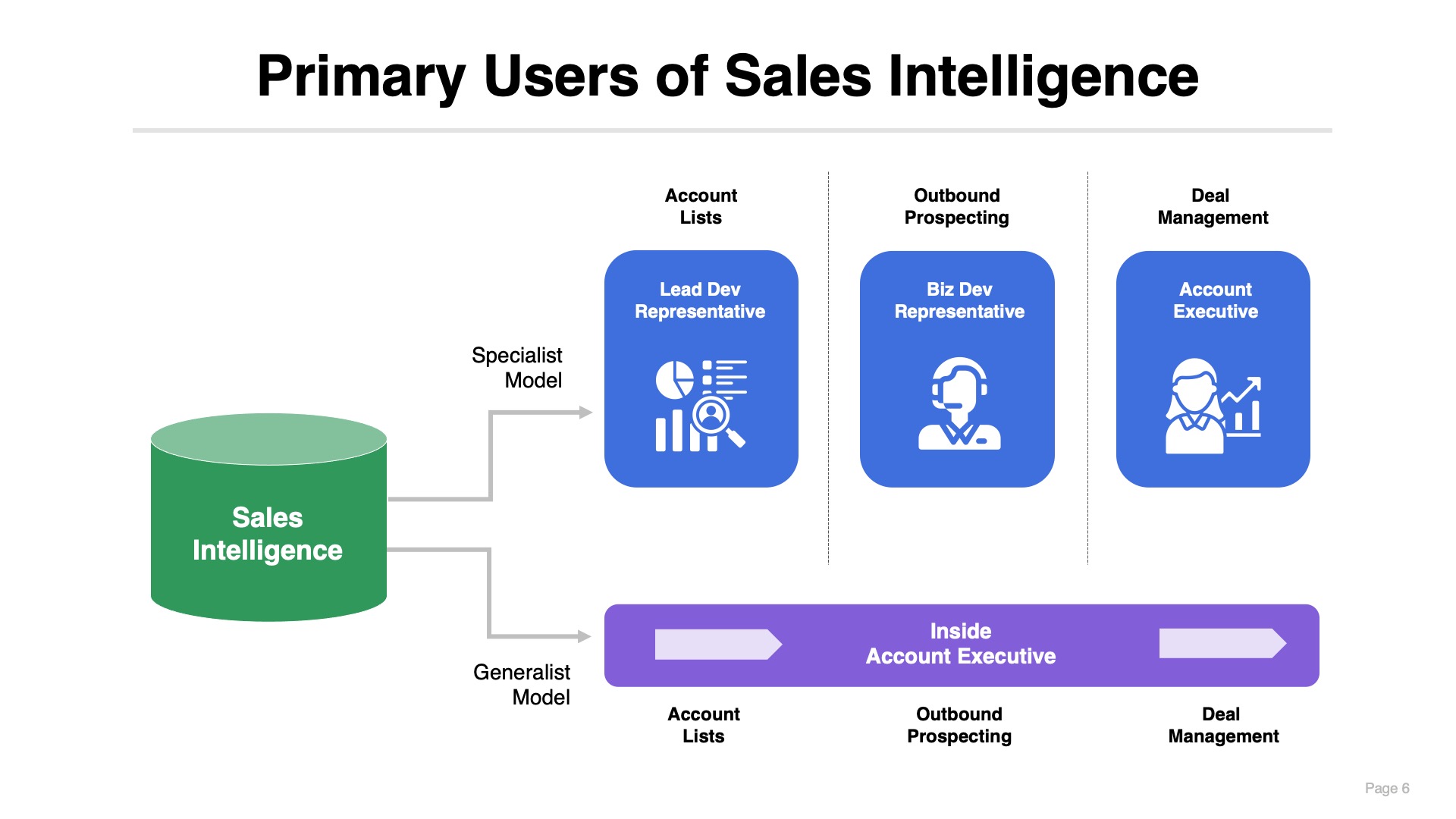

The Primary Users of Sales Intelligence

Account Executives (AEs) and Sales Development Representatives (SDRs) use sales intelligence tools to identify which accounts to call on and the specific decision-makers to target within each account. However, different companies use these tools differently depending on the go-to-market model. Some SaaS companies have highly specialized roles in which each team within the sales organization performs a specific function. For example, the SDR team might be charged with generating leads and then handing them off to account executives who work the deal. Other SaaS companies have hybrid models with less specialization. For example, an “Inside” account executive might be responsible for both prospecting for new leads and working small deals from the initial qualification through close.

Although the AEs and SDRs are the primary users of sales intelligence technologies, the administration of these tools usually falls on the shoulders of the sales operations team. Typically, sales ops (or revenue operations) have responsibility for managing the sales intelligence apps as part of the sales tech stack, including the CRM, CPQ, and other sales force automation tools such as Outreach, Salesloft, Instantly, Gong, DealHub, etc. The purchasing process for new sales intelligence tools is typically led by either the sales ops team or the SDR team.

Key Functions of Sales Intelligence Tools

The two core functions of sales intelligence tools are to provide account and contact-level data to sales teams.

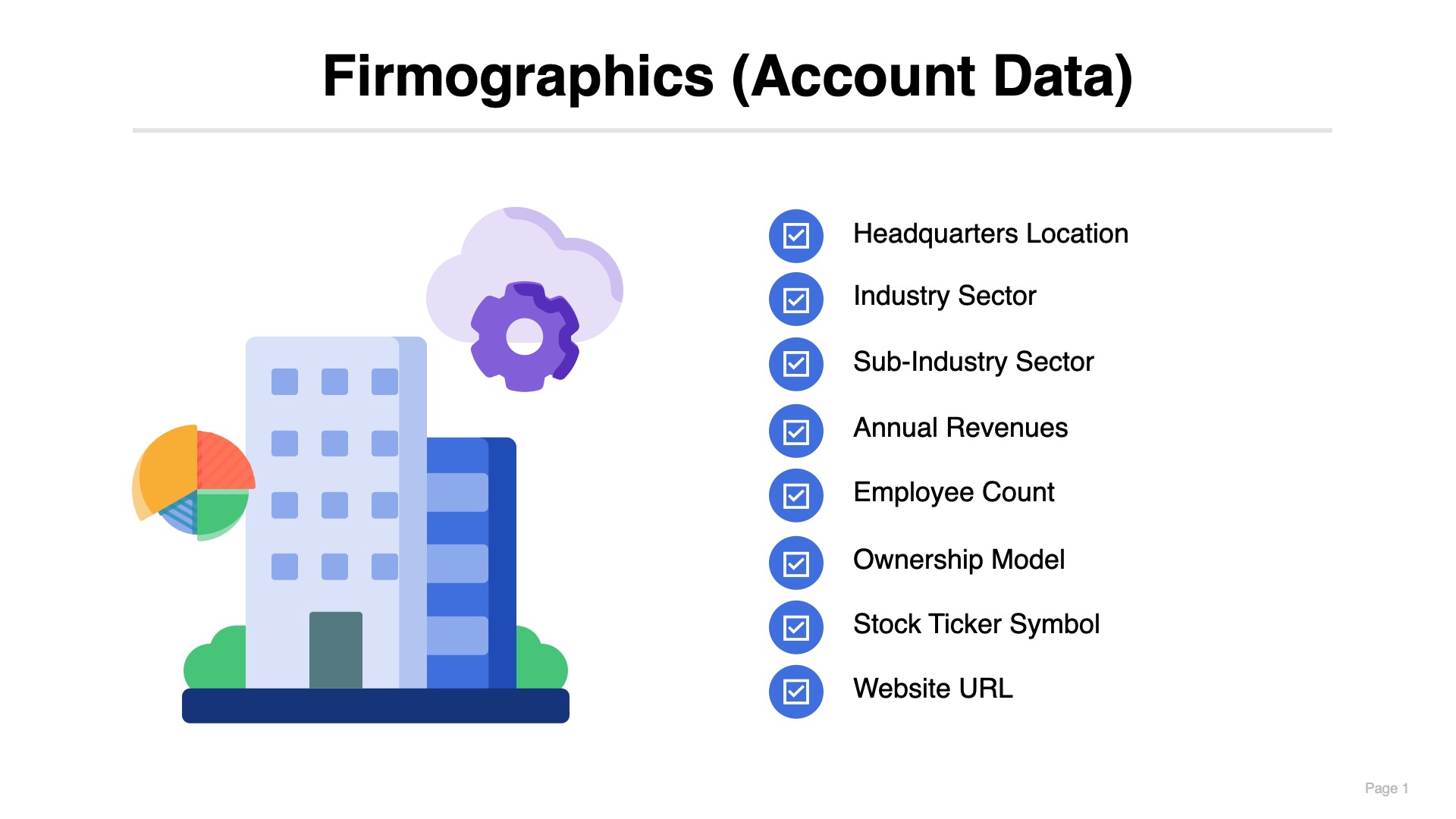

1) Account Firmographic Data

Sales teams must identify a list of accounts they want to target. Usually, the target list is derived based on the ideal customer profile for the SaaS company. Sales intelligence vendors simplify target account list creation by tracking millions of businesses in their databases and allowing sales teams to filter them using “firmographic” criteria such as the headquarters location, vertical industry, number of employees, and estimated annual revenues. Rankings and lists such as the Fortune 500, Global 2000, and Inc 500 are another type of firmographic data. Sales teams can use these filter criteria to identify a list of the biggest or fastest growing companies.

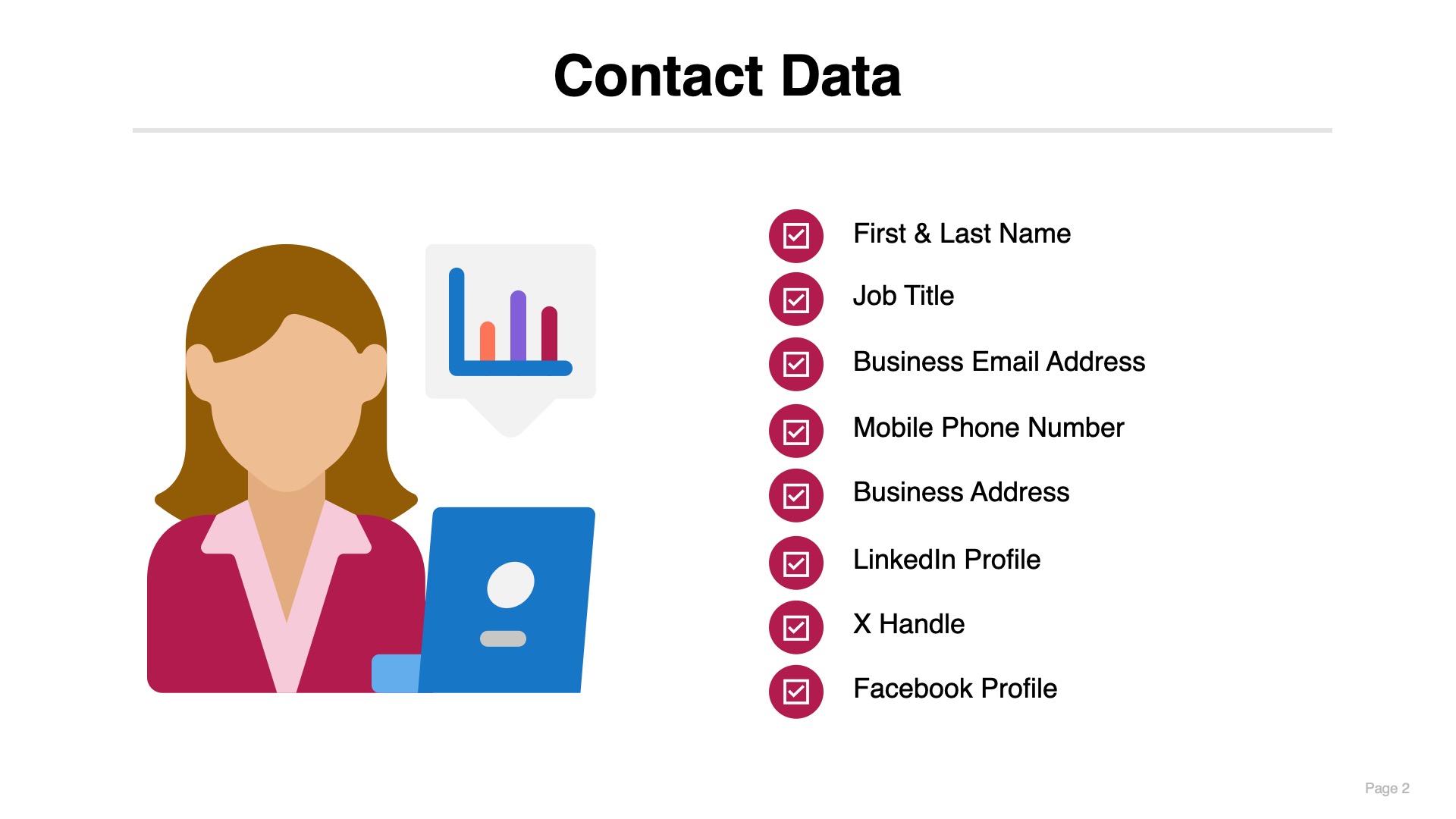

2) Contact Data

Sales teams not only need to know which accounts to target, but they also need to know who to call on within each account. Most SaaS companies have a list of target buyer personas that lead or influence the decision-making process. Examples might include the Chief Technology Officer (CTO), VP of sales, or head of human resources. Sales intelligence tools make it easy for SaaS companies to identify the relevant buyer personas in each account by allowing users to filter by account and job title or department. In addition to the first/last name, these tools will track the contact details for how to reach the person. The three most commonly used fields are business email address, LinkedIn profile URL, and mobile phone number. Additional fields include business phone, mailing address, and social media handles (X, Facebook).

In recent years, sales intelligence vendors have expanded their capabilities to include additional data feeds to help sales teams better identify and prospect target accounts.

3) Technographics

SaaS companies often build their products to work best on specific cloud platforms or to integrate with a relatively short list of third-party applications. Sales teams want to prioritize calling on accounts that use the technologies their service “works best with” to increase their odds of success. For example, if a SaaS company sells to developers, they may be interested in the cloud infrastructure platform that targets accounts such as Amazon Web Services, Google Cloud Platform, or Microsoft Azure. If a SaaS company sells to manufacturing companies, they may be interested in the ERP system target accounts use, such as SAP, Oracle, Infor, and Epicor. If a SaaS company sells to small businesses, they may be interested in the CRM applications used by each target account, such as Hubspot, Zoho, or Microsoft Dynamics.

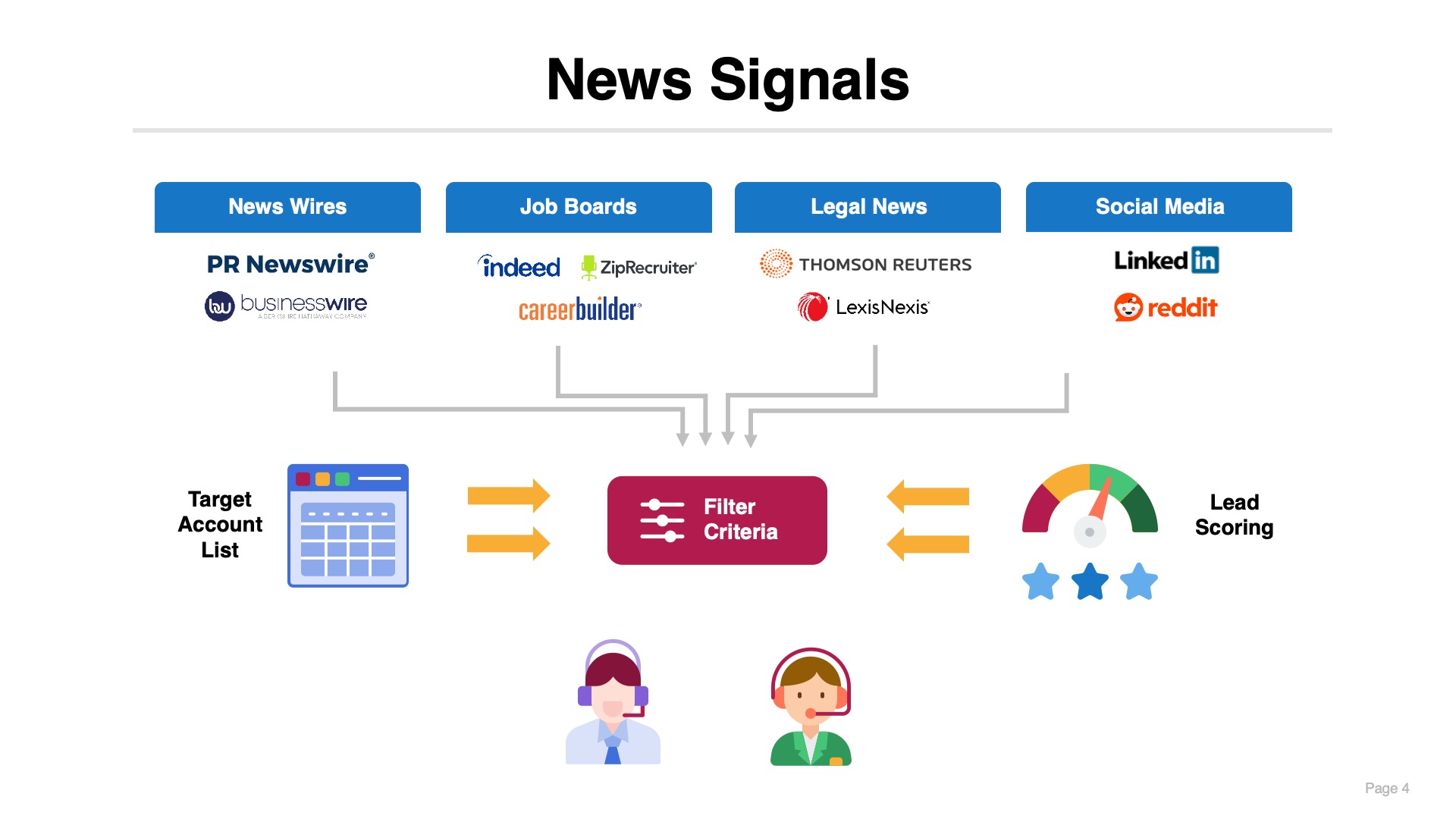

4) News Alerts

Purchasing cycles for many technology products often correlate with significant news announcements that are indicative of strategy changes or budget priorities. SDRs and AEs want to monitor these news signals so they can approach target accounts at the opportune time. Examples of news alerts include new fundraising rounds for private companies and quarterly earnings reports for public companies. Other signals include news related to mergers, acquisitions, and divestitures, hiring plans and recent layoffs, new product launches or partnership announcements, litigation or regulatory issues, and executive leadership changes.

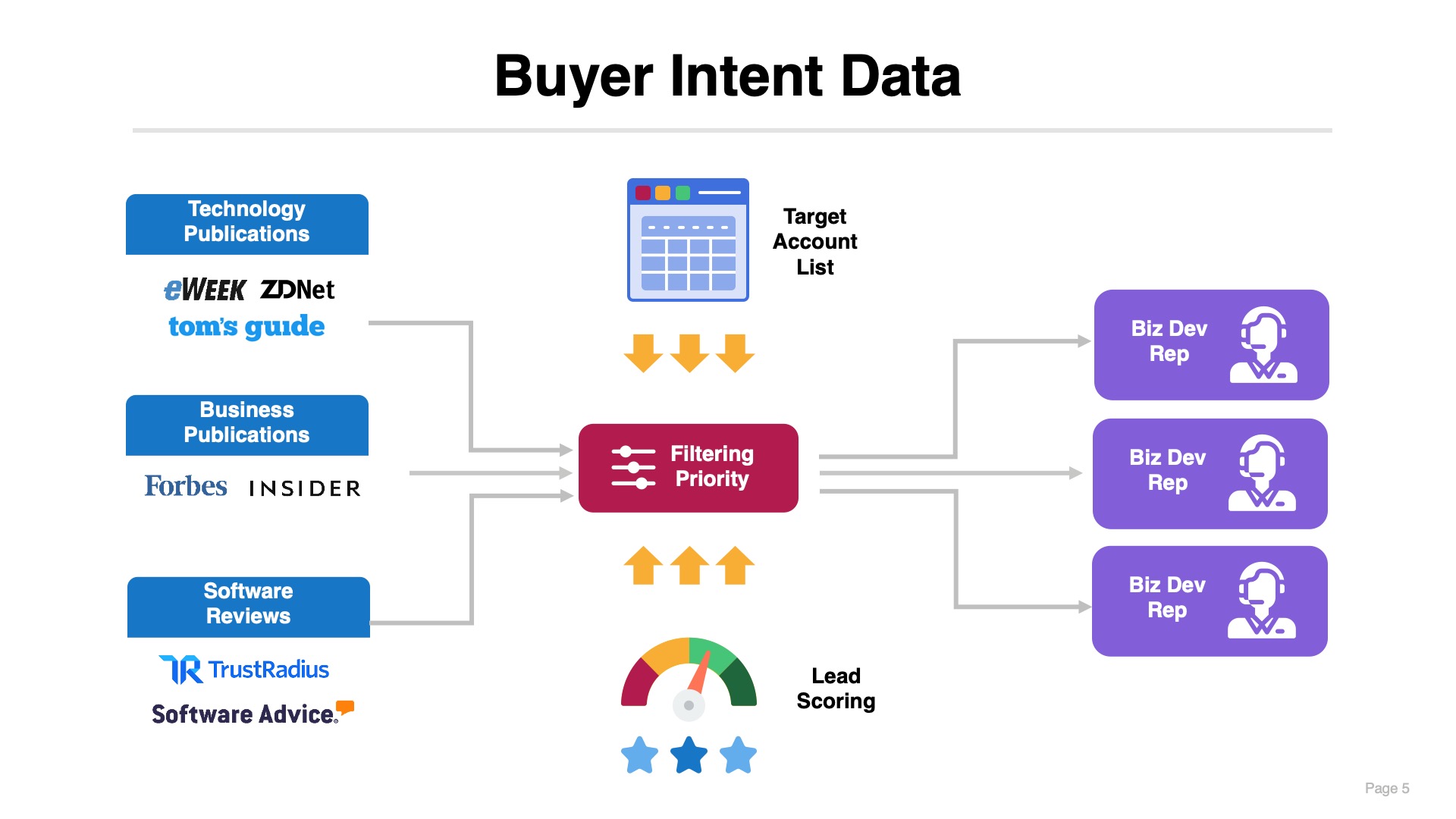

5) Buyer Intent Data

Sales teams want to engage potential prospects as early as possible in the purchasing cycle so that they can shape and influence the customer’s point of view on the problem and potential solutions. However, SaaS company websites typically are not often the first place prospective buyers go to perform research. Instead, they start on social media platforms and online forums. Others research on traditional media publications focused on specific industries, technologies, or business functions. Sales intelligence vendors provide visibility into early-stage prospects researching their technologies on third-party sites. This “intent” data is usually assigned a score indicating a high, medium, or low level based on the observed levels of activity.

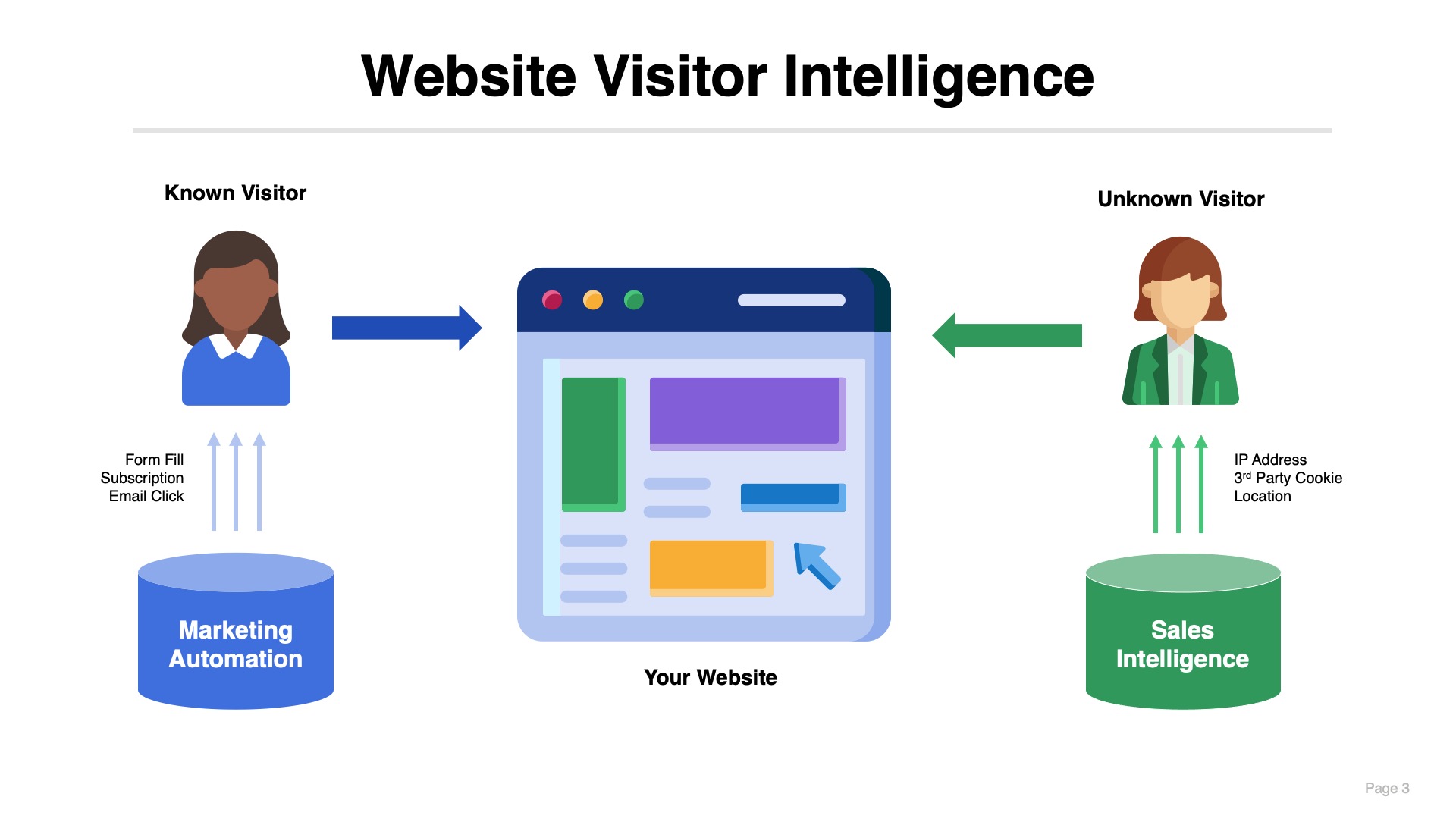

6) Website Visitor

In addition to monitoring third-party buyer intent data, sales teams also want to know who is visiting their own website. Visiting a SaaS company’s website is a high indication of purchasing intent. As a result, these are some of the promising leads for SDRs and AEs to pursue. However, identifying website visitors is not always easy. Most are anonymous. Unless the user has created an account, filled out a form, or subscribed to an email newsletter and a cookie was placed on their device, the website cannot uniquely identify the person. Sales intelligence vendors can help identify most anonymous website users based on their IP addresses. They have massive databases that track the IPs of business buyers worldwide. Some sales intelligence companies can identify the specific individual visiting a site, while others can only identify the company the user works for.

How Sales Teams Use Sales Intelligence

It is common for SaaS companies to use multiple sales intelligence tools. Even startups will typically have two to three different applications in use. Each sales intelligence tool has strengths and weaknesses. Some are better for large enterprises, while others have strengths in small business. Some have strong coverage of North American accounts, while others have better coverage of Europe or Asia. Some only offer account and contact data, while others offer a broader range of capabilities, including technographics, intent data, news signals, and anonymous website visitors.

Another big difference between platforms is the timeliness of updates. People switch jobs frequently. Sales intelligence tools need to keep track of millions of decision-makers around the world as they leave job A at company #1 and move to job B at company #2. The speed with which sales intelligence vendors can update job titles and company affiliations is another significant differentiating factor.

For example, LinkedIn Sales Navigator often has the most accurate and up-to-date information on job titles because it is self-managed by workers. However, LinkedIn doesn’t offer access to business email addresses or mobile phone numbers. As a result, sales teams use LinkedIn to identify the best contacts to target and then use ZoomInfo to find their contact details. However, no database is perfect. ZoomInfo is known for its great coverage of North America, but Cognism has better coverage of Europe. There are also instances where none of the tier 1 vendors might have contact information for some decision-makers. As a result, the sales team may need to consult tier 2 sources like Hunter or Lusha to identify the email address and mobile phone number.

Firmographic data often needs to be sourced from multiple sales intelligence vendors. LinkedIn is generally considered to have the best employee count data (indicative of company size) because it tracks the number of members who self-identify their relationship with an employer. However, self-managed data is not always a positive thing. For example, LinkedIn does not have reliable industry data because companies classify themselves inconsistently. For example, a vertical SaaS vendor selling into healthcare is more likely to identify themselves as being in the healthcare sector than in the software space.

New players like Clay are changing the way sales teams think about sales intelligence. Instead of relying on one or two primary sources, sales teams are now leveraging AI to collect information from a wide variety of sources across the web. In the new world, a SaaS company might have a contract with Apollo, but use Clay to augment and enrich contact and account profiles by searching through a dozen other sales intelligence tools, scraping websites, and social media to find additional information that can be used to personalize outreach.