Following two years of unusually low levels of new offerings in 2022 and 2023, the IPO market for B2B SaaS began to rebound in 2024. There were only a handful of new listings from the highest-quality performers.

- Opening – Date of the initial listing, the exchange (NYSE or NASDAQ), and ticker symbol

- Management Team – including the CEO, CFO, COO, and founders

- Advisors -Investment banks, legal advisors, and public accounting firms (auditors)

- Pre-IPO Investors – private equity, venture capital, growth equity

- Financials – Revenue, growth rate, and key operating metrics such as ARR, customer count, and net revenue retention

- SEC Filings – Links to the S-1 registration filing and the issuer’s pricing announcement

Rubrik IPO

Exchange and Ticker Symbol

Rubrik had its initial public offering on April 25th, 2024, just a few weeks after filing its S-1 registration statement with the SEC on April 1st. The cybersecurity provider began trading with the ticker symbol RBRK on the New York Stock Exchange. It was the first big B2B SaaS IPO of 2024 and one of the first tech companies to go public following the SaaS crash of 2022.

Mission Statement

“We are on a mission to secure the world’s data.

Cyberattacks are inevitable. Realizing that cyberattacks ultimately target data, we created Zero Trust Data Security to deliver cyber resilience so that organizations can secure their data across the cloud and recover from cyberattacks. We believe that the future of cybersecurity is data security—if your data is secure, your business is resilient.”

Products and Services

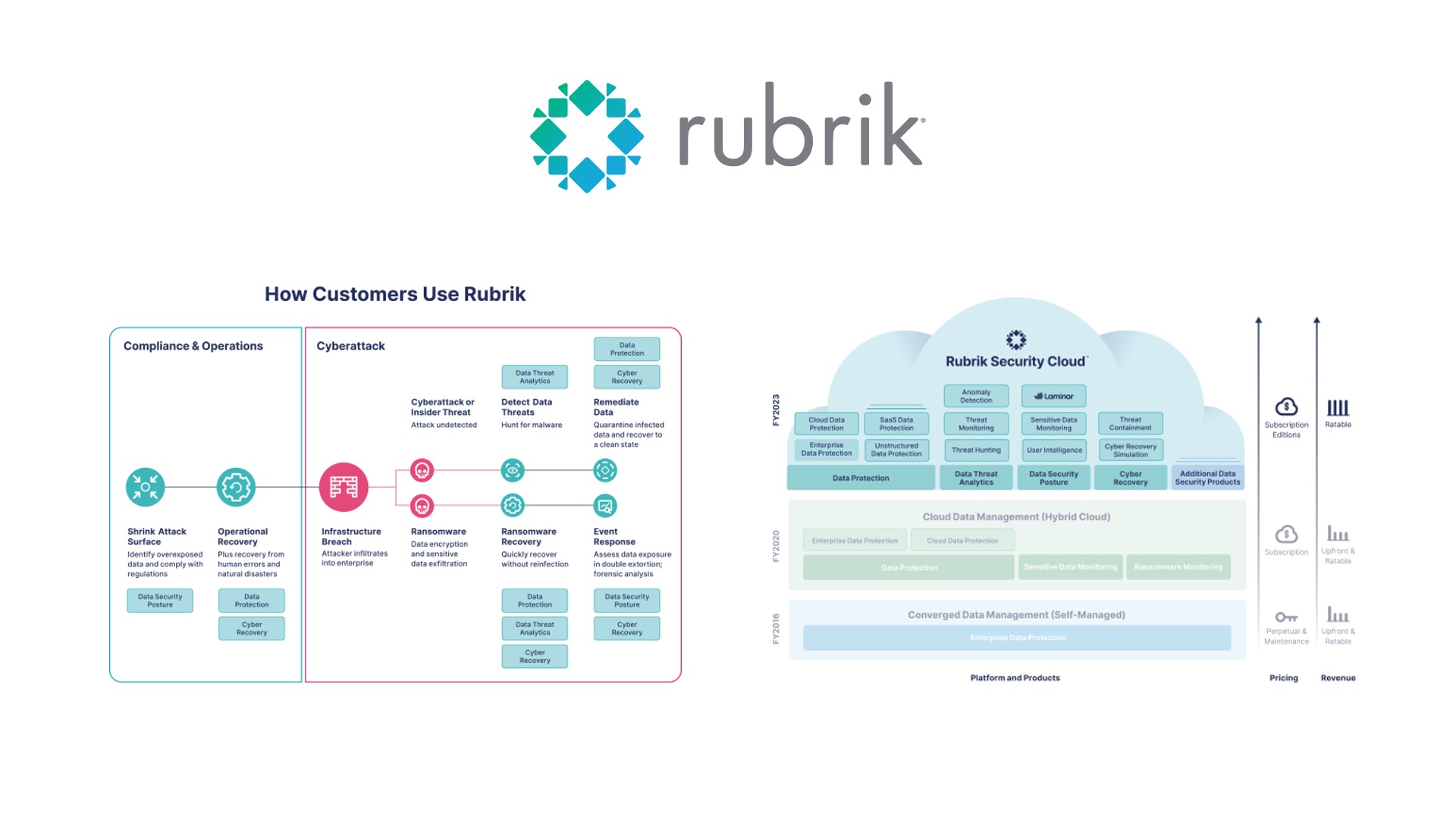

Palo Alto-based Rubrik offers a variety of cybersecurity services. Its data protection services back up on-premise and SaaS data for its customers into Rubrik’s cloud, providing business resiliency in the event that a customer is compromised by a cyberattack such as ransomware. Rubrik’s cyber recovery offering quickly restores applications, files, and objects to minimize the impact of a breach.

Rubrik also offers ransomware monitoring & investigation software that uses machine learning to detect anomalies, unusual access patterns, and other indicators to identify potential threats.

The company’s marketecture diagram is shown below.

Management Team

The IPO team was led by Bipul Sinha, Rubrik’s co-founder and CEO. A Wharton MBA, Sinha was a partner at Lightspeed Venture Partners prior to joining the company. Other key members of the management team include Kiran Choudary, the CFO, Arvind Nithrakashyap, the CTO and co-founder, and Brian McCarthy, the Chief Revenue Officer.

Revenues and Growth

Rubrik reported over $600M in revenue in the last full fiscal year prior to its IPO. The company has a mix of subscription revenue from hosted cloud offerings and term licenses for on-premise software. It also sells perpetual licenses, professional services, and hardware appliances. The company does not include maintenance fees associated with the perpetual licenses in its subscription revenues.

External Advisors and Bankers

- Investment Bankers – Goldman Sachs, Barclays, Citigroup, and Wells Fargo Securities were the lead underwriters for the Rubrik IPO.

- Legal Advisors – Cooley and Latham & Watkins were the principal legal advisors for the Rubrik IPO.

- Auditors – KPMG served as Rubrik’s auditor for six years, leading up to the initial public offering starting in 2018.

Pre-IPO Private Market Investors

Prior to its IPO, Rubrik raised over $500M in venture capital and growth equity through Series A through E rounds from leading firms such as Bain Capital, IVP, Khosla, Greylock, and Lightspeed.

SaaS Metrics

Almost $800M of subscription ARR with a year-over-year growth rate of almost 50%. Subscription revenue includes both as-a-service, cloud-based offerings as well as traditional on-premise licenses offered on a term basis.

Rubrik had over 6000 customers at its IPO across a wide variety of industries with concentrations in financial services, healthcare, education, public sector, technology, and retail.

Rubrik employs a land-and-expand strategy to grow its relationships with existing accounts. In its S-1 filing, the company reported an impressive 130=% dollar-based NRR for subscription revenue. Rubrik had approximately 1800 customers with greater than $100K ARR and about 100 with $1M+.

OneStream IPO

Exchange and Ticker Symbol

OneStream’s initial public offering was on July 24, 2024, when the company’s stock began trading under the symbol OS on the NASDAQ. The stock price surged 34% on opening day. Rubrik’s IPO was a few weeks after filing its S-1 registration statement with the SEC on June 28, 2024.

Vision Statement

Our vision is to be the operating system for modern Finance by unifying core financial functions and empowering the CFO to become a critical driver of business strategy and execution.

Products and Services

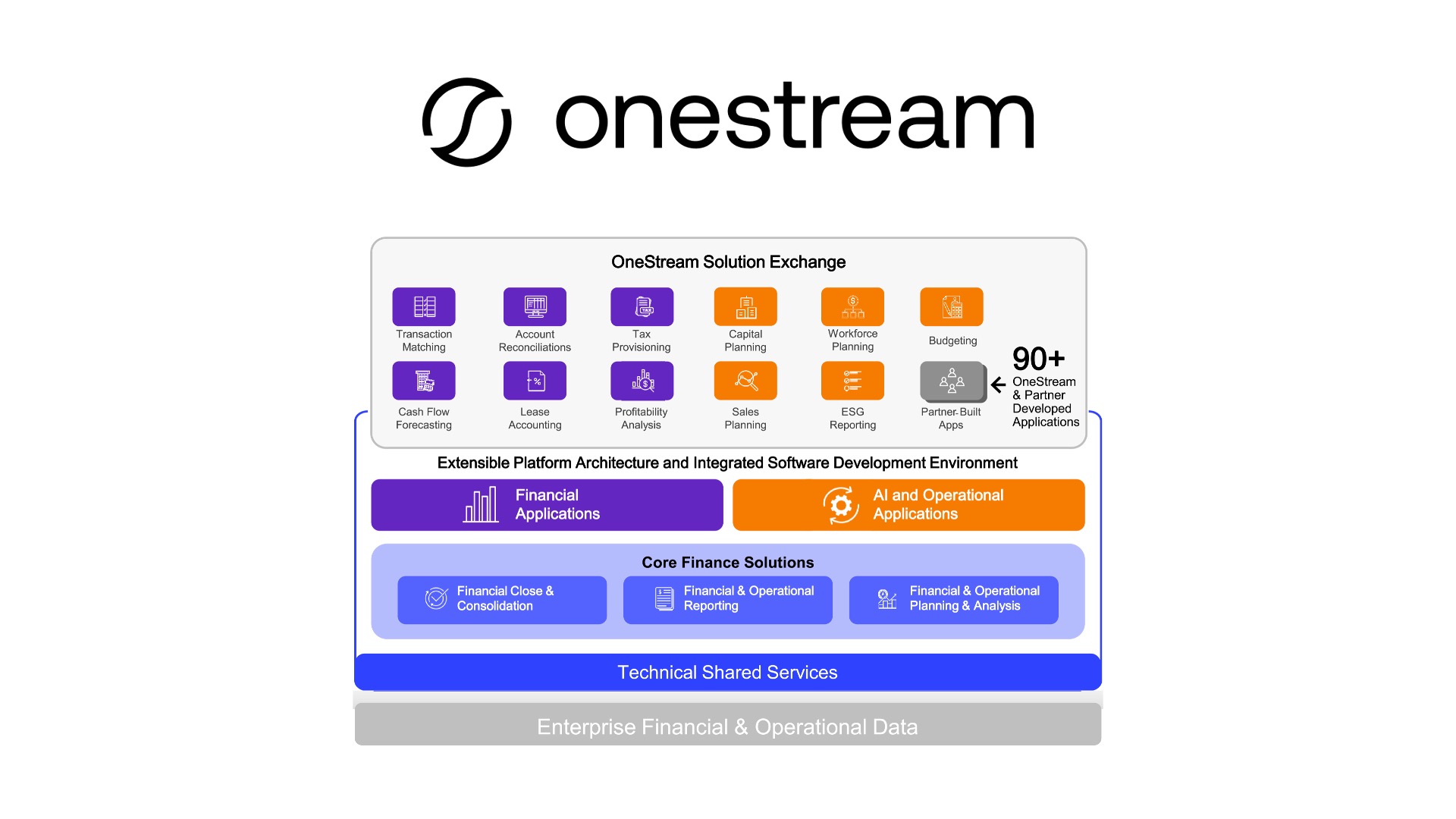

The Birmingham, Michigan-based company sells a suite of finance and accounting applications to the Office of the CFO. The budgeting, planning, and forecasting applications enable FP&A teams to track department and company-level expenses and revenues, as well as variance to plan. The financial reporting, close and consolidation applications help streamline the record-to-report process across business units and ERP systems.

The company’s marketecture diagram is shown below.

Management Team

The IPO team was led by Thomas Shea, the company’s CEO. Prior to founding OneStream, he founded UpStream, which was acquired by Hyperion in 2006. Shea co-founded the company with Craig Colby, who serves as President of OneStream. Other key members of the management team include William Koefoed, the CFO, a veteran tech leader with prior experience at Microsoft, Hewlett-Packard, PricewaterhouseCoopers, and Arthur Andersen.

Revenues and Growth

OneStream reported over $400M in revenue for the last fiscal year before the IPO with a 37% year-over-year revenue growth rate. The company’s revenues are primarily derived from SaaS subscriptions, but it also has perpetual and term-based software license revenue. Together, these software fees drive 90+% of total revenue. The remainder of OneStream’s revenue comes from professional services, including consulting, implementation, and configuration services.

External Advisors and Bankers

- Investment Bankers – Morgan Stanley, JP Morgan, and KKR were the lead investment bankers for the OneStream IPO.

- Legal Advisors – Wilson Sonsini and Latham & Watkins were the legal advisors for the OneStream IPO.

- Auditors – Ernst & Young served as OneStream’s auditors for the four years leading up to the IPO, starting in 2020.

Pre-IPO Private Market Investors

OneStream launched in 2012. Prior to its IPO, OneStream raised over $700M in capital from outside investors, including a majority sale to KKR and follow-on investments from Tiger Global Management and D1 Capital. The IPO valued OneStream at $4.6 billion, which was significantly lower than the company’s valuation in its 2021 funding round.

SaaS Metrics

OneStream reported over 1400 customers from a wide range of industries, including manufacturing, healthcare, retail, financial services, government, education, and technology. The company has a strong concentration of enterprise customers with over 500 accounts with ARR greater than $250K and almost 80 with $1M+ in recurring revenue. At the time of its IPO, OneStream was generating almost $500M in ARR.

OneStream has a strong focus on customer success, which is demonstrated by its unusually high 98% dollar-based gross retention rate. Customers typically begin with a limited set of finance modules then expand with additional applications over time. The strong customer expansion motion has led to a 118% dollar-based net retention rate.

Additional Analysis

Mostly Metrics – The Story of OneStream’s IPO

ServiceTitan IPO

Exchange and Ticker Symbol

ServiceTitan’s initial public offering occurred on December 12th, 2024. The company, which calls itself the operating system for the trades, debuted on the NASDAQ with the ticker symbol TTAN. ServiceTitan’s stock price rose 42% on the opening day, on what proved to be a great day for the stock market. The Nasdaq Composite Index closed above 20,000 for the first time, with Amazon, Alphabet, Tesla, and Meta all closing at record highs.

Mission Statement

In the company’s S-1 registration statement with the SEC, ServiceTitan outlined its mission and vision:

“ServiceTitan is the operating system that powers the trades.

We are modernizing a massive and technologically underserved industry—an industry commonly referred to as the “trades.” The trades consist of the collection of field service activities required to install, maintain, and service the infrastructure and systems of residences and commercial buildings. Tradespeople—like your local plumber, roofer, landscaper, HVAC technician and others who are employed in the trades—are immensely skilled and extensively trained. They are the essential, unsung heroes who work tirelessly to ensure that our needs are met where we live or work, ready at a moment’s notice to leave their families in the middle of the night to go across town to help others.”

Products and Services

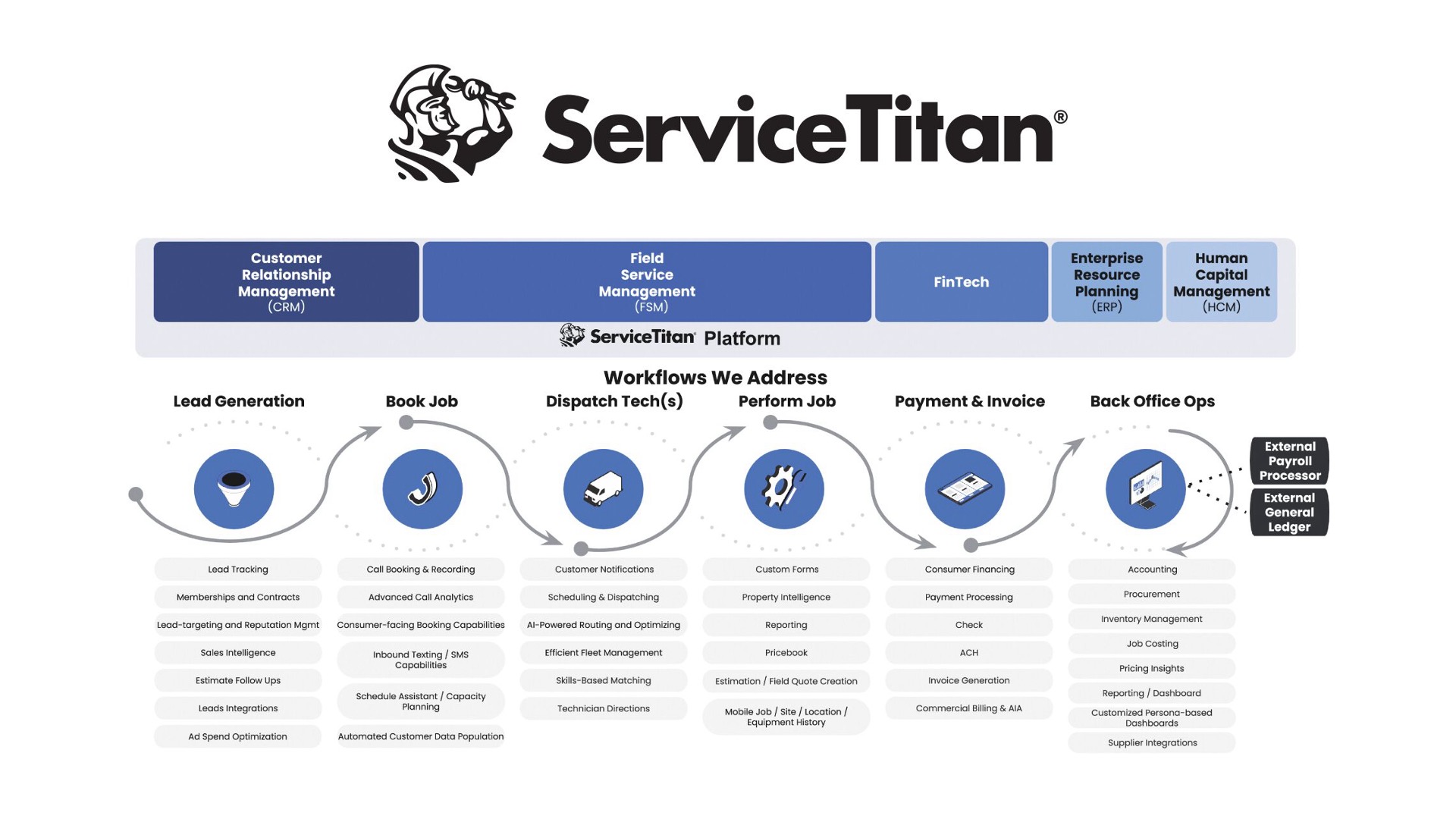

ServiceTitan describes itself as the operating system that powers the trades. The vertical SaaS company offers a suite of applications for small businesses, providing services such as plumbing, landscaping, electrical, landscaping, and custodial services to both residential and commercial properties. The applications cover the full customer lifecycle from marketing and lead generation through scheduling and dispatching, field service, and call center support. ServiceTrade also offers back-office applications to help their customers with job costing, procurement, inventory management, payroll, invoicing, financing, and payments.

The company’s marketecture diagram is shown below.

Management Team

The ServiceTitan IPO team was led by Ara Mahdessian, the company’s CEO, a Stanford engineering graduate. Mahdessian has been CEO since he founded the company in 2007. Other key members of the management team included Vahe Kuzoyan, president and co-founder, and Dave Sheery, the company’s Chief Financial Officer.

Both founders were descendants of immigrants who arrived in the US with no money, no English language skills, and no jobs, but a strong work ethic that enabled them to achieve the American dream.

Revenues and Growth

ServiceTitan’s revenues were unusually high for a B2B SaaS IPO. In the last full fiscal year before the IPO the company generated almost $700 in revenue with a 24% year-over-year growth rate.

The primary source of ServiceTitan’s revenue is from subscription fees – generally charged per user – for access to the various applications. The company also generates variable revenue, primarily from financial services offered to customers, such as payment processing fees. About 5% of ServiceTitan’s revenue comes from professional services such as onboarding, implementation, and configuration support.

The company was not profitable at the time of IPO, but reported a 77% Non-GAAP platform gross margin.

External Advisors and Bankers

- Investment Bankers – Goldman Sachs, Morgan Stanley, Wells Fargo Securities, and Citigroup were lead underwriters for the ServiceTitan IPO.

- Legal Advisors – Latham & Watkins and Wilson Sonsini were legal advisors for the ServiceTitan IPO.

- Auditors – PricewaterhouseCoopers served as ServiceTitan’s auditors for the seven years leading up to the IPO, starting in 2017.

Pre-IPO Private Market Investors

ServiceTitan was founded in 2007 and raised over $1B in outside capital prior to its IPO. Investors included venture capital and private equity firms, including Bessemer Venture Partners, ICONIQ, Battery, Index, Sequoia, Tiger Global, and ThomaBravo.

SaaS Metrics

The breadth of ServiceTitan’s offerings enable it to grow relationships with accounts over time, upselling and cross-selling applications for customer relationship management, enterprise resource planning, field service management, human capital management, and financial management. ServiceTitan boasted an impressive 95% gross dollar retention rate of 95% leading up to its IPO and a net dollar retention of 110%.