CAC payback period is one of the most closely watched metrics that investors review to understand the efficiency of a SaaS company’s sales and marketing. In simple terms, CAC payback period measures how quickly SaaS companies recover their sales and marketing costs after they acquire a new customer.

Not every SaaS company calculates CAC payback period the same way. Most companies include all new customers, while others exclude certain segments, such as those acquired through distribution channels. Most SaaS providers express CAC payback period in months, while others use longer intervals, such as quarters.

The revenues included in the calculation also vary, with some SaaS providers using ARR (annual recurring revenue) and others utilizing GAAP revenue or ARPU (average revenue per user).

The biggest variations relate to the sales and marketing expenses that are included in the CAC payback period calculation. Some SaaS providers exclude certain costs, such as stock-based compensation and overhead allocations, such as recruiting or office supplies. Some exclude fixed costs, such as the in-house marketing personnel. A few SaaS companies use a subset of expenses more tightly correlated with new customer acquisition, such as just the performance marketing costs (versus brand marketing).

- Klaviyo

- Bill.com

- Toast

- Fiverr

- Carta

- SimilarWeb

How Klaviyo calculates CAC Payback Period

Klaviyo is a publicly traded MarTech company that offers a CRM as well as email and SMS text messaging for B2C brands. Klaviyo uses CAC Payback Period to monitor how many months it takes for its gross profits to exceed sales and marketing expenses. The company uses “adjusted selling and marketing expenses” which excludes stock-based compensation expenses and a prepaid marketing expense tied to a Shopify warrant. Klaviyo measures over a 12-month period.

“We define our Customer Acquisition Cost, or CAC, payback period as the number of months it would take for our non-GAAP gross profit to exceed our adjusted selling and marketing expenses. We calculate our CAC payback period as of any date of determination by first calculating the change in revenue from the date that was twelve months prior to the date of determination to the revenue on the date of determination. We then multiply the change in revenue by our gross margin as calculated over the twelve months preceding the date of determination, but excluding any impact of stock-based compensation expense. We then divide that amount by our selling and marketing expense over the same preceding twelve-month period, adjusted to exclude the impact of stock-based compensation expense and amortization of a prepaid marketing expense associated with the Shopify Warrants (as defined in the section titled “Certain Relationships and Related Party Transactions”). We then obtain the quotient of (i) 12 and (ii) the resulting amount to arrive at our CAC payback period.”

Source: Klaviyo SEC Form S-1 registration statement for IPO

How Bill.com calculates CAC Payback Period

Bill.com is a publicly traded CFOTech company that offers a suite of products including accounts payable, accounts receivable, expense reporting, spend management, and payment processing services. Bill.com measures CAC Payback Period not in months, but by the number of quarters.

“Defined as the number of quarters it takes for the cumulative non-GAAP gross profit earned from BILL customers acquired during a given quarter to exceed total sales and marketing spend in that same quarter, excluding customers acquired through financial institutions and the related sales and marketing spend.”

Source: Bill.com Q3 FY25 Investor Deck

How Toast calculates Payback Period

Toast is a publicly traded vertical SaaS company that provides a full suite of technology to restaurants. Toast’s approach to calculating Payback Period is interesting for a few reasons. First, Toast includes not only sales and marketing expenses but also costs for hardware and professional services which it uses strategically as customer acquisition tools. Second, Toast doesn’t calculate payback period on a per customer basis, but by cohorts of new locations and product upsells that go live in a given month.

Another noteworthy aspect of Toast’s payback calculation is how the company calculates gross margins for its different products. Toast offers subscriptions for most of the applications that run on point-of-sale devices, restaurant kiosks, and kitchens. It also generates revenue from processing customer payments for orders placed for in-store, carry-out, and delivery. The gross margin for the payments products is based on the first three months of revenue, presumably because the monthly fees are variable and there is no way to confidently forecast a longer time period.

“Toast utilizes the hardware and related professional services as customer acquisition tools and price them competitively to lower barriers to entry for new locations. As a result, the variable cost associated with manufacturing and configuring the hardware and providing the professional services has historically exceeded the related revenue Toast collects, resulting in negative gross profit for each. Toast considers these net costs of hardware and professional services, in addition to the sales and marketing expenses, to be the core components of the customer acquisition costs (“CAC”). For a given cohort of new locations and product upsells that go live on the Toast platform in a given month, CAC is calculated as the in-month hardware and professional services gross profit plus the sales and marketing expense incurred two months prior, which is based on the median time between when a location is signed and when it becomes a live location. To evaluate payback period, Toast compares CAC to the estimated contribution profit from the same cohort of live locations and upsells, which is defined as (i) the subscription component of MRR for the cohort, less the estimated costs to service these fees, plus (ii) the average payments component of MRR in each new location’s first three full months live on our platform, less the estimated support costs to service these fees.”

Source: Toast Investor Day presentation May 2024

How Fiverr calculates Payback Period

Fiverr is an Israeli-based company that offers a marketplace to connect freelancers with businesses needing services. Over 700 different categories of services are advertised on the marketplace. Some of the most popular services are graphic design, programming, content writing, and video animation.

Fiverr doesn’t calculate CAC payback period, specifically but it uses a similar metric it calls “Time to ROI.” The key difference is that Fiverr doesn’t measure all sales and marketing expenses in its formula, but just the performance marketing investments that represent the costs directly correlated with new customer acquisition. Brand marketing and fixed labor costs are excluded from its Time to ROI calculation. Fiverr includes a list of the performance marketing programs included in its payback calculation in the company’s investor reports.

“We measure the efficiency of our buyer acquisition strategy by Time to Return On Investment, or tROI, which represents the number of months required for us to recover performance marketing investments during a particular period of time from the revenue generated by the new buyers acquired during that period. We aim to achieve quarterly tROI of one year or less. Historically, over the past eight quarters ending December 31, 2023, we have been able to consistently achieve tROI of less than six months.

1 Performance marketing investments in new buyer acquisition is determined by aggregating online advertising spend across various channels, including search engine optimization, search engine marketing, video and social media used for buyer acquisition. Our performance marketing investments exclude certain fixed costs, such as brand advertising and fixed labor costs. Our performance marketing investment differs from sales and marketing expenses presented in accordance with GAAP and should not be considered as an alternative to sales and marketing expenses. Our performance marketing investment has limitations as an analytical tool, including that it does not reflect certain expenditures necessary to the operation of our business, and should not be considered in isolation. Certain fixed costs are excluded from performance marketing investments and related tROI calculations because performance marketing investments represent our direct variable costs related to buyer acquisition and its corresponding revenue generation. tROI measures the efficiency of such variable marketing investments and is an indicator actively used by management to make day-to-day operational decisions.”

Source: Fiverr SEC Form 20-F for fiscal year ending December 31, 2023

How Carta calculates CAC Payback Period

Carta is a privately held company that’s offers a CFOTech application primarily to early-stage companies backed by venture capital firms. Carta’s equity management applications track all the investors in a company on a cap table, which details the number of shares held, the equity type (common vs preferred), and liquidation preferences. Carta also provides applications to manage employee stock options.

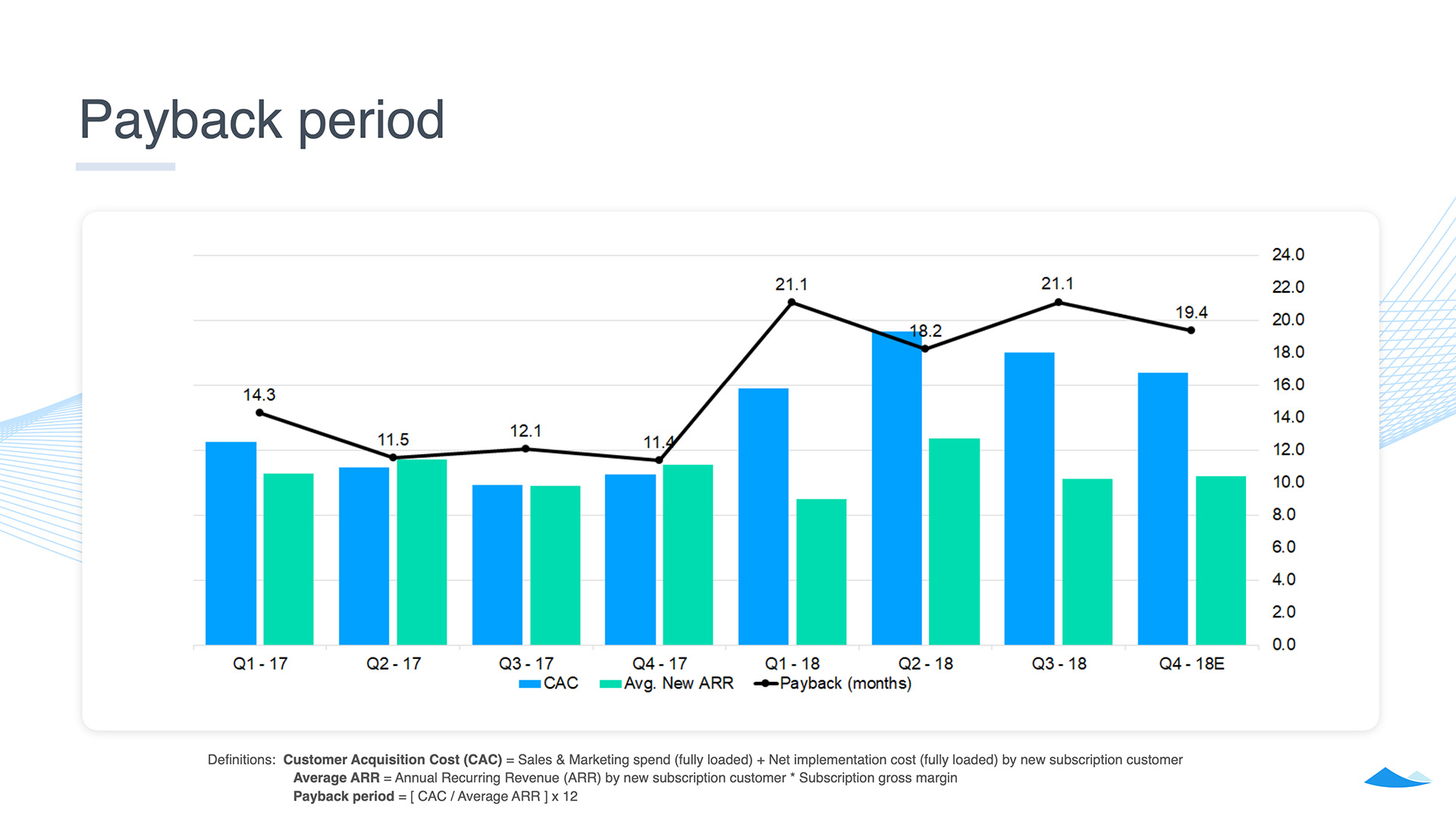

As a private company, Carta does not have to provide definitions of operating metrics to the general public, but it does regularly present its financials at investor conferences. Below is a slide from a 2019 presentation the company provided which includes its formula for CAC payback period.

Carta’s approach to calculating CAC payback period is interesting because it includes all of its acquisition costs. In addition to sales and marketing expenses, Carta also includes implementation services provided through its professional services organization.

Customer Acquisition Cost (CAC) = Sales & Marketing spend (fully loaded) + Net implementation cost (fully loaded) by new subscription customer

Average ARR = Annual Recurring Revenue (ARR) by new subscription customer * Subscription gross margin

Payback period = [CAC / Average ARR] × 12

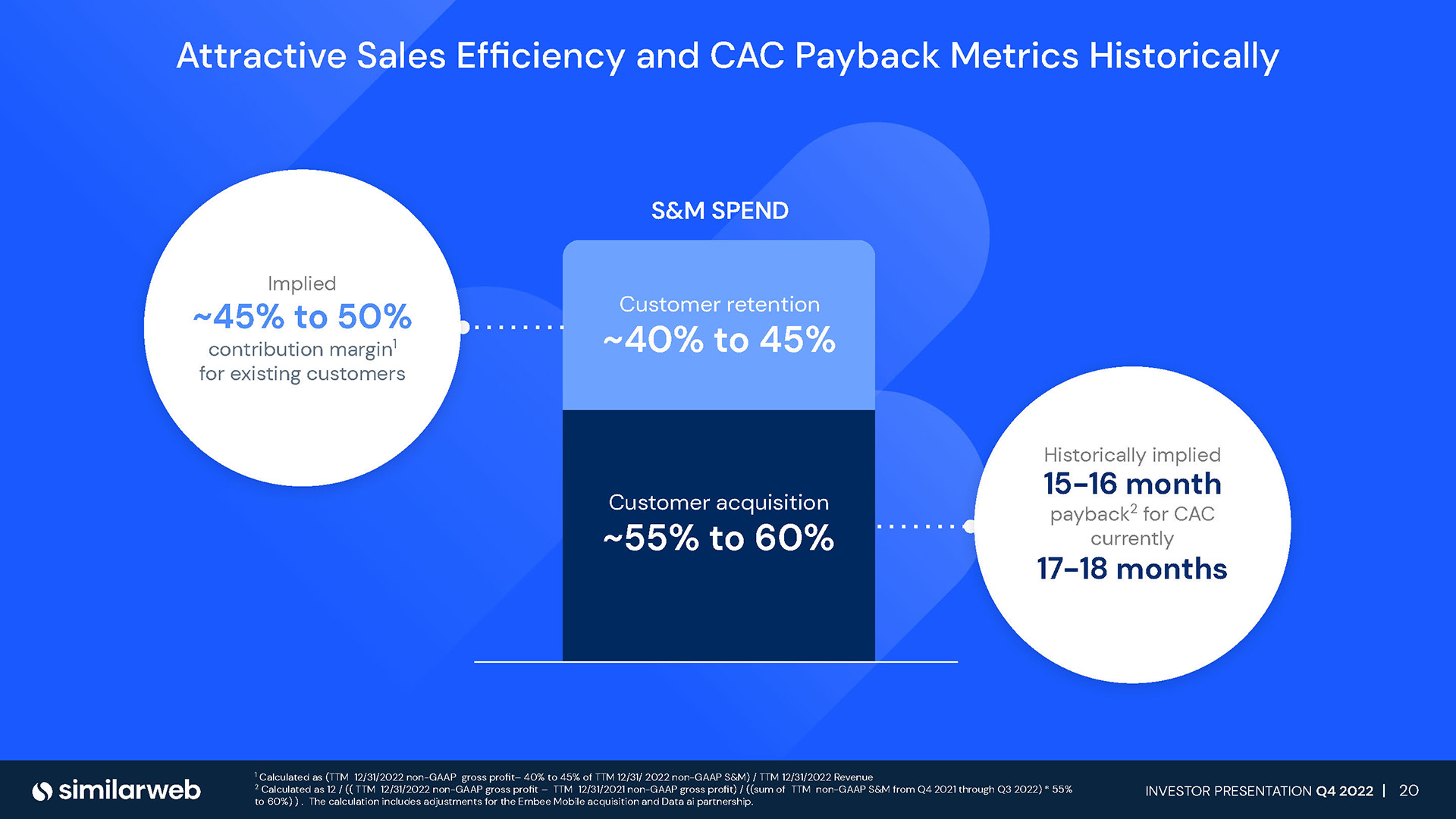

How SimilarWeb calculates CAC Payback Period

SimilarWeb is a data service that gathers market intelligence on website technographics, advertising trends, and mobile app performance. The company packages its offerings into different bundles targeted towards corporate sales and marketing departments. SimilarWeb also has alternative data offerings for institutional investors. The company was started in Israel, but its headquarters are in New York City and its stock trades on the New York Stock Exchange.

SimilarWeb regularly reports on its CAC payback period in investor presentations. The company splits its sales and marketing investment between acquiring new customers and retaining existing accounts. In the footnote of the slide below, SimilarWeb shows its formula for calculating CAC payback period.

CAC Payback Period is calculated as 12 / (( TTM 12/31/2024 non-GAAP gross profit – TTM 12/31/2023 non-GAAP gross profit) / ((sum of TTM non-GAAP S&M from Q4 2023 through Q3 2024) * 45% to 50%) )

SimilarWeb uses a standardized approach for the calculation, but there is one notable difference. SimilarWeb allocates only 45-50% of its total sales and marketing costs to customer acquisition.

Source: SimilarWeb 4Q24 Investor Presentation dated Feb 16, 2025