Five Firms with Amazing Content

Investors bet big on thought leadership

In the past few years the venture capital industry has emerged as a source of thought leadership in SaaS and cloud. While each of the big firms have a content strategy, there are a handful that have placed big bets on content and are creating a buzz in the market. Five that have caught my attention over the past few years are a16z, Bessemer Venture Partners, Insight Partners, and OpenView Partners, and Meritech Capital.

What the Industry is Talking About

Most of the focus for venture capital marketing programs centers around six key topics:

- Operating Metrics – Educating the market on KPIs such as LTV/CAC, net dollar retention, and the magic number.

- KPI Benchmarking – Publishing average and best-in-class performance for each of the metrics at different stages of growth.

- Scaling Up – Best practices for hiring and operating each of the key functions from sales and marketing to finance and human resources.

- Lessons Learned – Examples of both successes and failure from CEOs of leading SaaS/cloud companies who’ve scaled up.

- Emerging Tech – Predictions and technology roadmaps for hot areas such as generative AI, blockchain, and enterprise apps.

- Growth Strategies – Evangelizing new go-to-market, product strategies, and operating models that lead to breakthrough growth like PLG and ABM.

In this article, we will summarize the content marketing strategies that five firms are using to gain mindshare with thought leadership. We’ll also share links to a few of the best examples. Finally, we will wrap up with an explanation of the three primary audiences for venture capital content marketing.

Let’s review them in alphabetical order.

a16z (Andreesen Horowitz)

Content Strategy

a16z is, of course, the well-known venture capital firm founded by Marc Andreesen and Ben Horowitz back in 2009. a16z invests in a wide range of companies at all stages of the lifecycle from early-stage seed and venture to late-stage, pre-IPO organizations. Some of its more notable exits include Box, Facebook, Airbnb, Groupon, Roblox, and Lyft.

a16z’s content strategy is both broad and deep. Thought leaders have published viewpoints on a wide range of consumer and business-facing segments such as biotech, creator economy, gaming, social media, cryptocurrency, blockchain, and fintech.

One area that a16z covers at considerable depth is consumer marketplaces. Starting in 2020, the firm began publishing the Marketplace 100 which is the definitive listing ranked based on annual gross merchandise value (GMV). The a16z Marketplace 100 is forward-looking, aiming to identify not only the largest, but also the new, rising stars achieving the highest growth rates.

a16z also stands out in its content around generative AI. There are in-depth articles around the architecture for LLM applications. There’s also an AI glossary and a canon, which is a curated list of required reading for those wanting to get up to speed on the topic.

In addition to its research on various technology categories, a16z also publishes a set of best practices for operating companies. Most of the content is in text format, but they also have a growing library of videos and podcasts. Recent “must-read” content from a16z includes a comprehensive guide to hiring that details best practices in hiring C-level executives including advice on compensation strategies, stock option grants. and specific articles on how to scale the go-to-market, operations, and technology organizations.

You can subscribe to a general newsletter that features the best of a16z content or opt-in to topical updates on enterprise SaaS, fintech, consumer, or biotech.

Bessemer Venture Partners

Content Strategy

Bessemer Venture Partners (BVP), one of the oldest venture capital firms, traces its routes back to the Carnegie Steel empire. BVP has been part of 130 IPOs in the last 50 years including Twilio, LinkedIn, Wix, Toast, Shopify, and Pinterest.

Bessemer was one of the first venture capital firms to place an emphasis on thought leadership. Back in 2013, the firm launched the BVP Cloud Index, which has become the benchmark index to track the performance of publicly traded SaaS and cloud companies. BVP was also a pioneer in the area of identifying and ranking the fastest-growing private technology firms. In 2016 it partnered with Forbes to publish the Cloud 100, which stack-ranks companies based on sales, growth, valuation, culture, and other factors. Along with the Cloud 100, Bessemer also publishes an annual State of the Cloud report, quantifying trends in IPOs, M&A, and VC funding.

Bessemer also recently introduced the concept of a Centaur (private technology company with $100M ARR), which has effectively displaced the unicorn ($1bn valuation) as the ultimate goal of every founder.

The firm has published a comprehensive online guide on how SaaS and cloud businesses can scale to $100M in ARR and reach Centaur status. It walks through all of the key metrics (ARR, growth endurance, gross/net retention) that SaaS firms need to measure along their journey and offers performance benchmarks for each phase of growth. There is an accompanying go-to-market guide for sales and marketing leaders aspiring to reach $100M.

You can subscribe to their newsletter to get the most recent content updates on the topics above as well as their thoughts on product-led growth and pricing strategies.

Insight Partners

Content Strategy

Insight took an early lead in evangelizing the importance of metrics and benchmarks for SaaS companies. They were one of the first investor firms to organize all the relevant SaaS metrics for sales organizations into a periodic table format. They now offer a library of content around metrics including a comprehensive online guide to understanding the relevant metrics at each phase of growth – early-stage (< $10M ARR), mid-stage ($10-$100M ARR), and late-stage ($100M ARR).

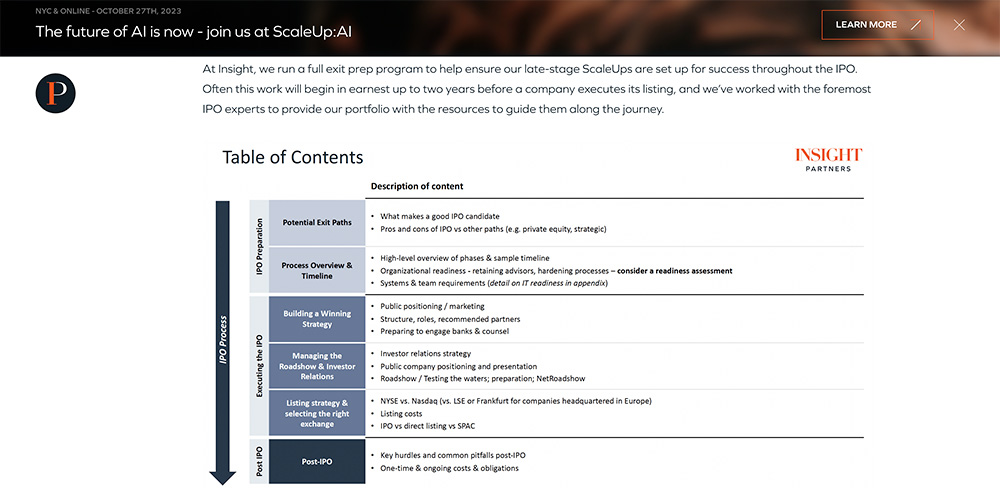

Over the past five years, Insight has established itself as one of the top advisors in how SaaS companies scale up. For example, there is a Scale Up to IPO guide that covers the key activities SaaS companies need to perform in the planning, execution, and post-IPO phases of the lifecycle including advice on how to conduct a readiness assessment, how to plan for an investor roadshow, and how to hire an investment banker.

There is also discussion on the tradeoffs to consider in listing on the NYSE versus the NASDAQ as well as the pros and cons of executing an IPO, direct listing, or SPAC.

The firm has published comprehensive guides on how to scale up every function from GTM teams like sales, marketing, and customer success to G&A functions such as finance and talent acquisition. There are also more detailed guides on specific sub-functions within each organization. For example, there are marketing guides how to scale up industry analyst relations and federal government channels. Much of the content is only available to Insight’s portfolio companies on their GO portal, but a handful of newer guides are available for download on the website.

Insight also publishes regular blog post series on growth strategies, talent acquisition, and the explosion of new artificial intelligence technologies.

OpenView Partners

Content Strategy

OpenView focuses on funding expansion stage companies typically in Series A, B, and C rounds. Some of their notable successes include investments in Calendly, DataDog, and Expensify. OpenView is not as large as the other three firms listed in this article. The firm makes fewer than 10 investments per year. However, in the area of thought leadership and content marketing they significantly punch above their weight having built a massive following in the SaaS and cloud community over the past few years.

The weekly newsletter, Growth Unhinged, now boasts over 30,000 subscribers. OpenView has been able to tap into the expertise of its portfolio companies (and the broader SaaS community) to produce the type of rich, insightful content that SaaS CEOs are craving. The blog site has over 800 pages of content, each with 9 or more articles. It’s not all text, however. OpenView also has a podcast channel and a weekly video series named PLG123.

Key to the firm’s success has been placing big bets and focusing on a few core strategic topics such as product-led growth (PLG) and usage-based pricing – for which interest has surged in recent years. For example, OpenView has arguably the most comprehensive set of content on PLG. There are case study interviews from successful PLG companies such as Hootsuite, Pinecone, and Hotjar. They have also developed a series of guides addressing the unique challenges of the PLG model – topics such as the alternate role of sales and marketing in assisting the buying process and the new set of operating metrics such as PQLs that should be measured.

OpenView also does an excellent job of introducing original concepts that no one else is discussing yet. Examples include creating reverse trials, offering ungated products, and creating a sales-assist role. By introducing and branding these new concepts, they not only gain greater mind share in the SaaS community and become the de facto authority.

Although PLG is what they are best known for, the firm also produces a lot of insightful material on the next era of work, pricing strategies, talent benchmarks, and SaaS metrics.

Meritech Capital

Content Strategy

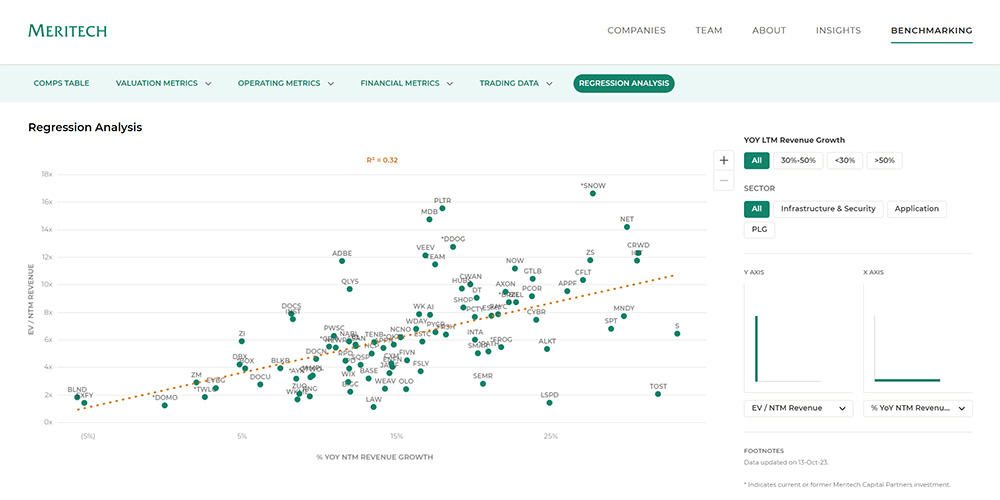

Meritech is perhaps, not as well known as the other firms on the list, but has an impressive list of investments in Coupa, DataDog, MuleSoft, NetSuite, Pendo, Salesforce, Snowflake, Tableau, and UiPath. They certainly rank in the top 10 when it comes to thought leadership and insights. In addition to publishing some of the most comprehensive financial analyses of SaaS companies that I’ve seen, they have also created an interactive benchmarking tool. Available for free on their website, Meritech Benchmarking has all the valuation metrics, non-GAAP financials, and trading history for over 100 SaaS companies. The tool enables you to filter and stack rank public SaaS companies based on equity value, magic number, net retention, payback period, and over a dozen other metrics.

Meritech also publishes extremely comprehensive S1 teardowns for new SaaS IPOs that summarize the product offering, market opportunity, cap table, go-to-market strategy, and competitive landscape as well as all the financials and operating metrics. A few of the more recent teardowns include Klaviyo and Instacart, but there also a number of interesting reads from 2021 and 2020 for companies such as HashiCorp, Confluent, WalkMe, Monday.com, and Squarespace. Also noteworthy are the state of the industry reports Meritech has published over the past 5 years as the SaaS industry has gone on the rollercoaster ride during COVID and the post-pandemic SaaS crash.

Target Audiences for Venture Capital Content Marketing

You may be wondering why these firms investing so much time and energy into building great content. The goal is to establish themselves as thought leaders with future business partners and portfolio companies. There are three primary audiences for venture capital content marketing programs:

1) Future Portfolio Companies

VCs are always on the hunt for the next big thing. All the big firms want to be one of the lucky few that get to invest early in a hypergrowth company like OpenAI or CoreWeave. Once they identify a potential decacorn, they need to convince the founder/CEO that they are the best investor to fund the business. Part of the selling process is to secure the investment is demonstrating the value-add they can provide to the startup on scaling their business and reaching their aspirational goals.

2) Current Portfolio Companies

VCs want to maximize the ROI on their portfolio investments. To the extent possible, they want CEOs at startups to avoid first-timer mistakes like making bad hires, burning out employees, or raising insufficient capital to capture the market opportunity. More and more firms are documenting the best practices they have identified from analysis of successes and failures with prior investments. Publishing the ideas in the form of blogs, podcasts, video and other content formats helps to provide educational materials for portfolio companies and distribute the knowledge.

3) Institutional Investors

VCs need to raise capital for new funds from limited partners. Typically the LPs are pension funds, university endowments, sovereign wealth funds, and life insurance companies. Institutional investors are trusting VCs with hundreds of millions of dollars, if not billions, want confidence that the firm has strategy for maximizing success. Having documented best practices to guide portfolio companies as well as technology roadmaps for hot growth areas such as AI, blockchain, and cybersecurity help to boost confidence.