Monthly, pay-as-you-go plans are an important new customer acquisition strategy for SaaS companies. It serves a similar purpose to the free trial. A monthly plan lowers the friction required for the customer to experience the product. Unlike an annual plan which requires a 12-month commitment with no option to terminate, the monthly plan offers a low-risk, low-cost option to try out the service with the flexibility to cancel at any time.

How Monthly Plans Work

With a monthly plan, the customer can experience the product without making an annual commitment or entering into a formal contract arrangement with the SaaS or cloud provider. The customer will typically pay the list price (no discount) for the service. A form of payment is required and automatically charged each month if the customer does not cancel. Month-to-month arrangements are typically temporary in nature. In most cases, the customer either abandons the use of the product or commits to it and enters into an annual contract.

- Activation – Customer visits the SaaS provider’s website and registers to use the product. In many cases, the customer is given access to the product immediately to start using.

- Payment – Form of payment is required to gain access to the paid version. Credit card is the most common payment option.

- Billing – The customer is typically charged in advance for products that have a fixed fee, subscription-based pricing and in arrears for products with a variable fee, usage-based pricing model.

- Commitment – Do not enter into a long term contract, but are effectively committing to pay for the product for the next 30 days.

- Discounting – Typically there is no discount offered for month-to-month contracts. Discounts are offered as an incentive to switch to an annual plan.

- Cancellation – If the customer does not cancel by the start of the next billing period, the customer is effectively auto-renewing for another month.

Monthly Plans vs Annual Contracts

Most SaaS and cloud providers would prefer to have their customers on annual or multi-year contracts rather than monthly plans. A number of SaaS providers have eliminated the monthly plan option in recent years including Google Workspace and Microsoft 365.

Annual contracts provide more a more predictable revenue stream. With the annual contract the customer does not have the option to terminate the agreement until it expires. SaaS and cloud providers will typically offer a discount of 10%, 15% or 20% to customers to obtain an annual commitment.

Most SaaS and cloud providers will present pricing in terms of monthly fees, but for annual contracts most collect the full balance of 12-months payment in advance at the start of the contract.

Strategies for SaaS Monthly Plan Pricing

Discounts for switching from monthly to annual plans range from 10% to 45%. Excluding the outliers, most SaaS companies are in the 13-20% range. Most SaaS providers require annual plans to be paid in full upfront. However, a limited number offer a lower price for annual commitments that are billed monthly.

SaaS companies offer multiple plans with different entitlements and features—think good, better, best. The monthly pay-as-you-go option is rarely offered for the top-tier plans. Most “Enterprise” plans are only available with an annual contract.

Freemium and paid monthly plans are both new customer acquisition strategies, but they are not mutually exclusive. Most SaaS providers that offer paid monthly options also offer freemium packages as well. Some offer free trials that convert to monthly plans.

10 Examples of SaaS Monthly Plan Pricing

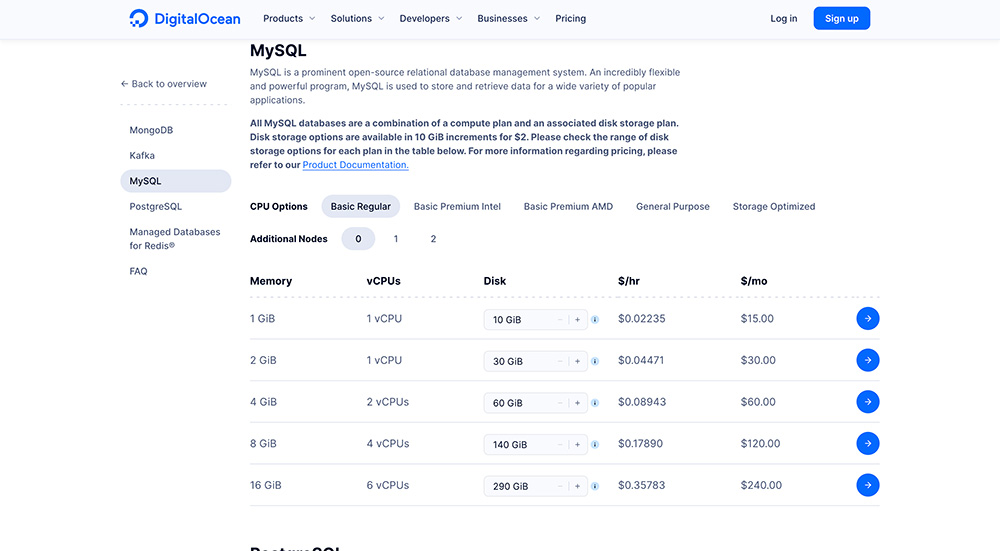

Below are ten examples of successful SaaS companies that offer monthly plans. The examples are all companies with fixed fee subscription pricing. Note that many cloud infrastructure providers also offer pay-as-you-go monthly plans as well.

For each example, we provide a high-level teardown comparison of the number of plans, the number with monthly options, and the discount level offered to switch to an annual commitment.

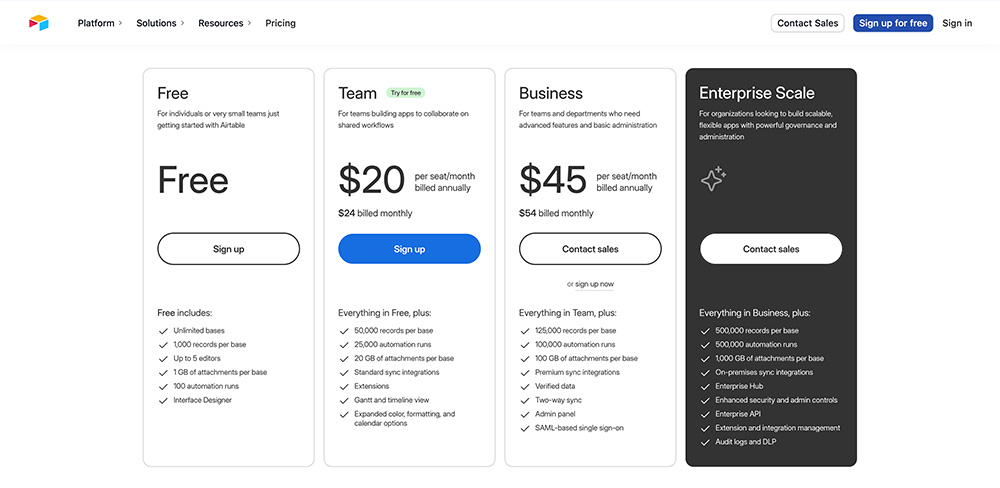

Airtable

- Number of Paid Plans – 3

- Plans with Monthly Pricing – 2

- Free Plans – Freemium

- Discount for Annual Plan – 20%

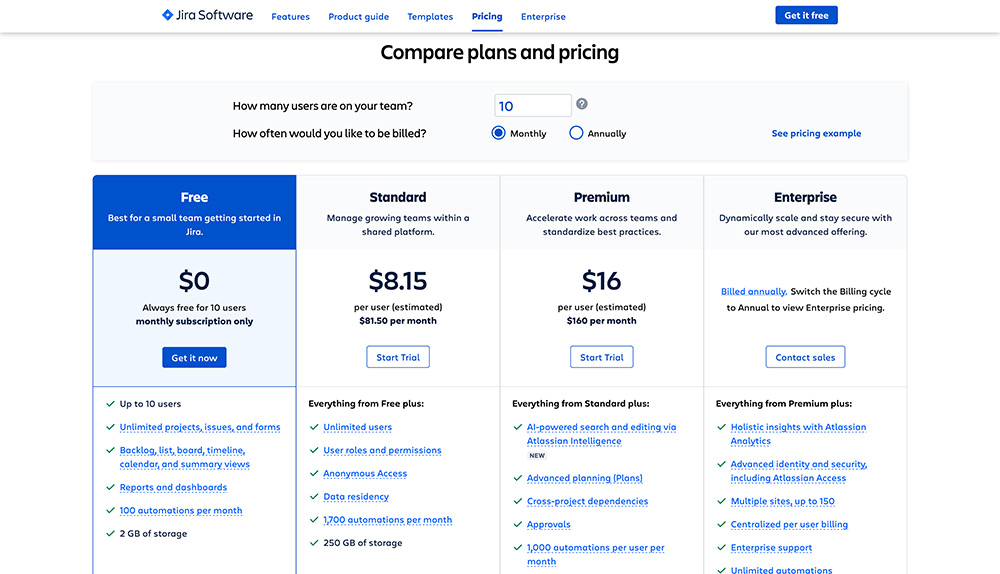

Atlassian Jira

- Number of Paid Plans – 3

- Plans with Monthly Pricing – 2

- Free Plans – Freemium

- Discount for Annual Plan – 13%

- Noteworthy – Annual plan requires a commitment of 10 seats vs. only 1 for monthly

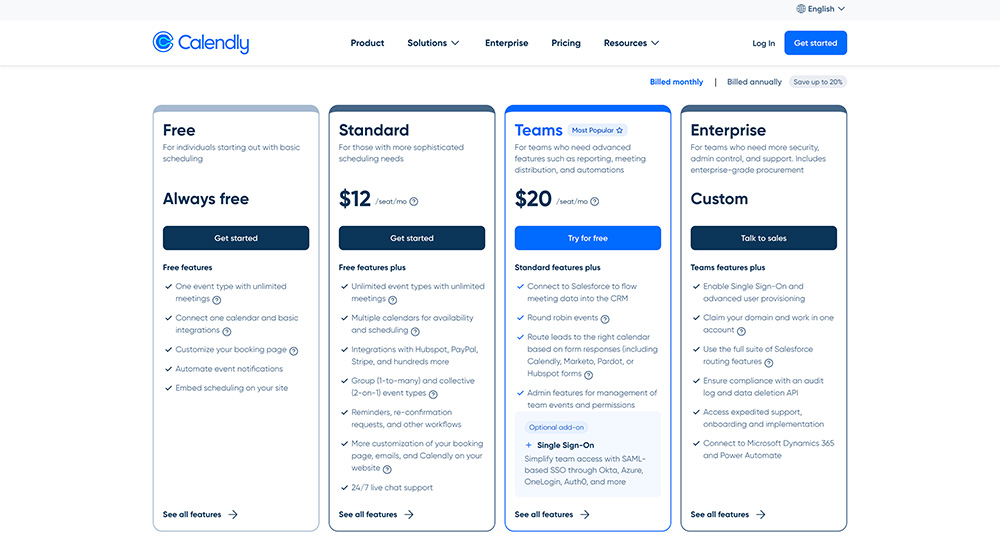

Calendly

- Number of Paid Plans – 3

- Plans with Monthly Pricing – 2

- Free Plans – Freemium

- Discount for Annual Plan – 20%

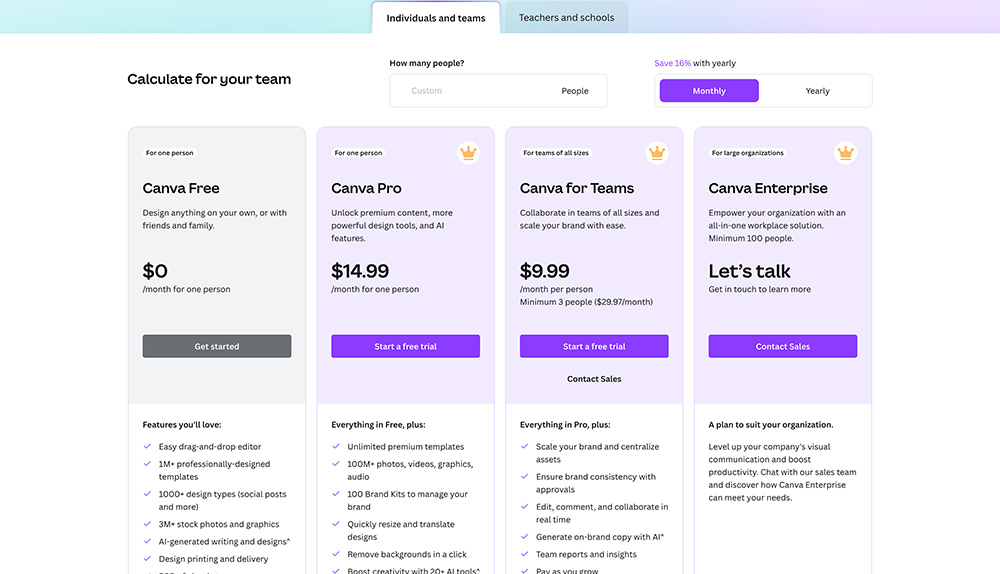

Canva

- Number of Paid Plans – 3

- Plans with Monthly Pricing – 2

- Free Plans – Freemium plus free trial for paid plans

- Discount for Annual Plan – 16%

Docusign eSignature

- Number of Paid Plans – 4

- Plans with Monthly Pricing – 3

- Free Plans – None

- Discount for Annual Plan – 44%

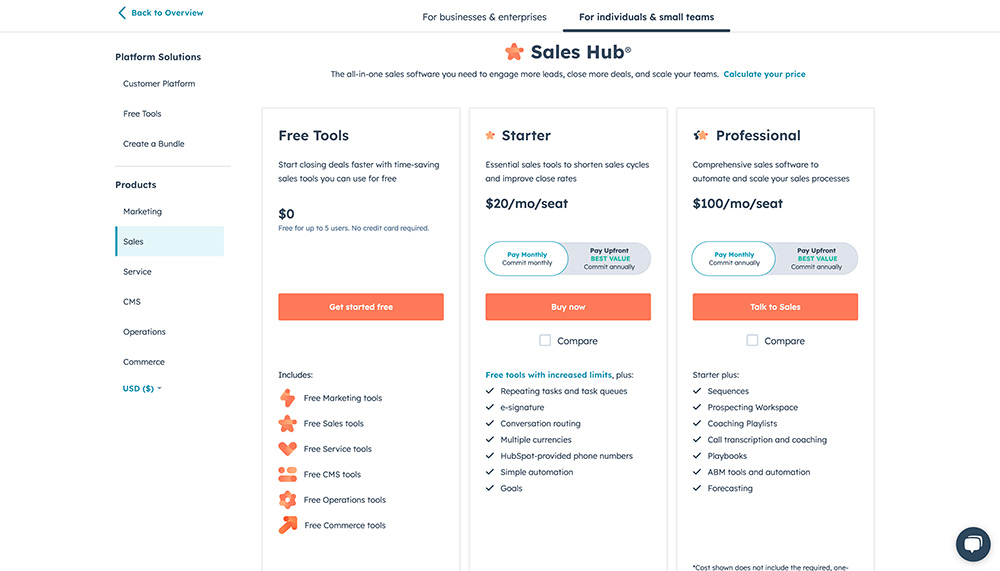

Hubspot Sales Hub

- Number of Paid Plans – 3

- Plans with Monthly Pricing – 1

- Free Plans – Freemium

- Discount for Annual Plan – 25%

- Billed Monthly for Annual Plan – Yes. Discount of 10% for paid in advance upfront.

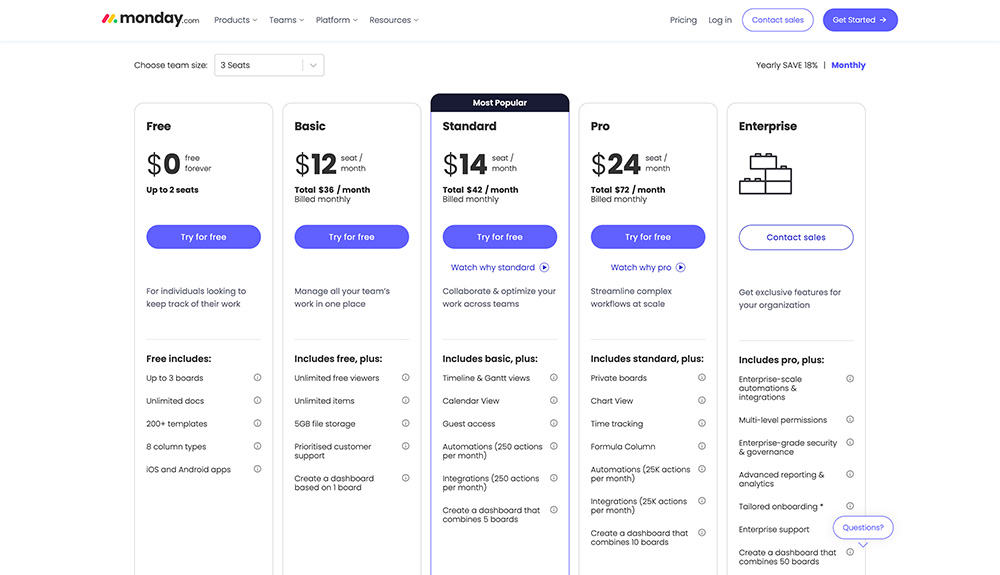

Monday.com

- Number of Paid Plans – 4

- Plans with Monthly Pricing – 3

- Free Plan – Freemium plus free trial for all paid plans

- Discount for Annual Plan – 18%

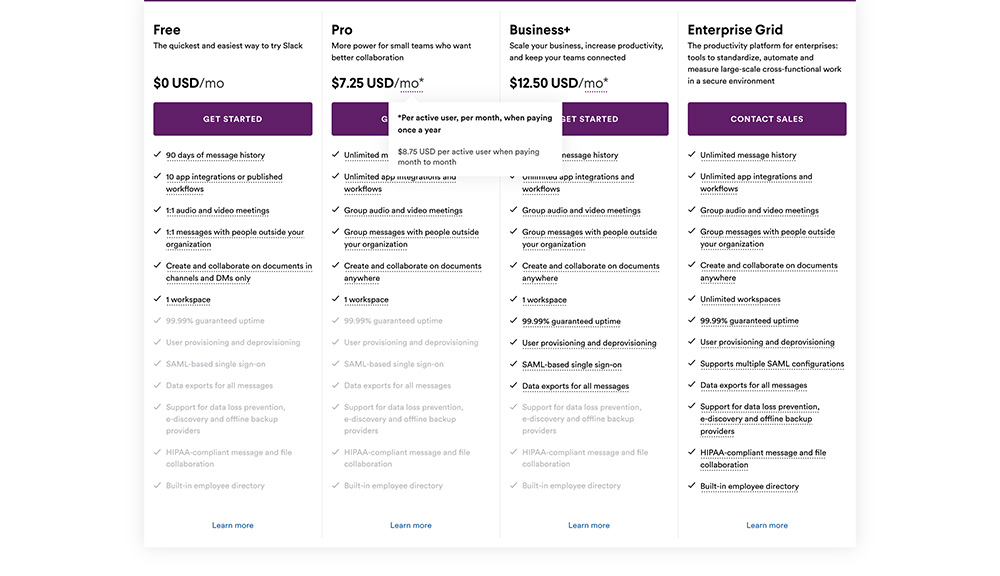

Slack

- Number of Paid Plans – 3

- Plans with Monthly Pricing – 2

- Free Plan – Freemium

- Discount for Annual Plan – 17%

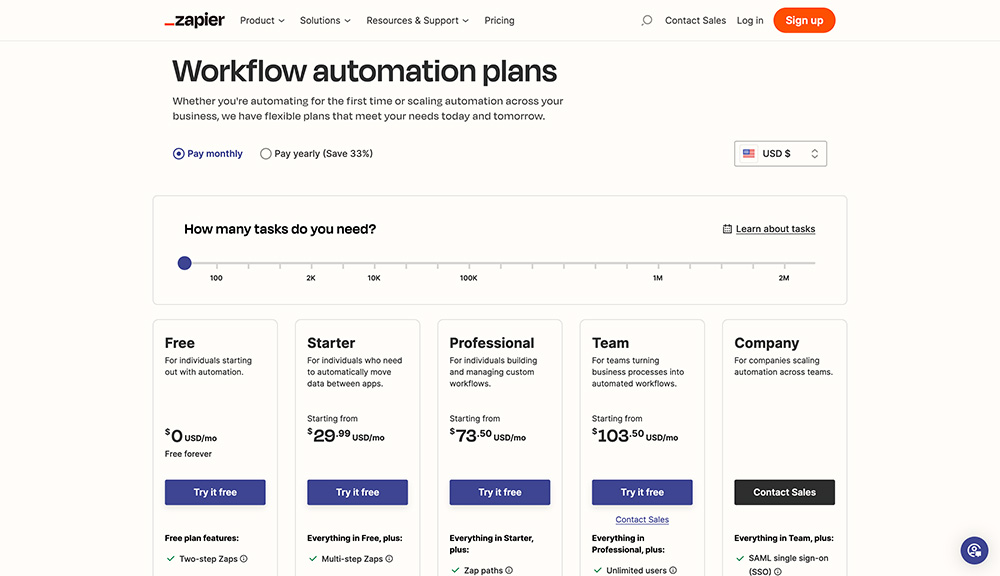

Zapier Workflow Automation

- Number of Paid Plans – 4

- Plans with Monthly Pricing – 3

- Free Plan – Freemium

- Discount for Annual Plan – 33%

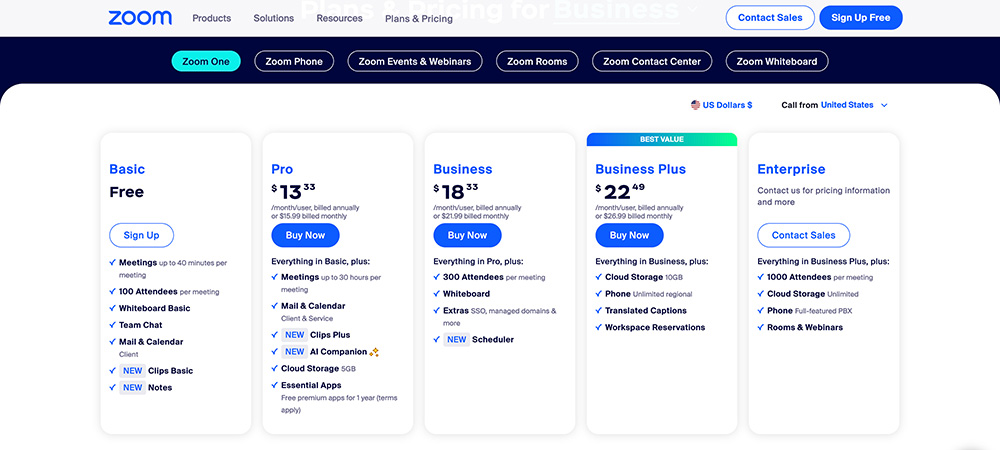

Zoom One

- Number of Paid Plans – 4

- Plans with Monthly Pricing – 3

- Free Plan – Freemium

- Discount for Annual Plan – 17%